Pivotal Moment For Markets

Weak numbers/uncertain statistics/markets look to set up recession trades

S&P 500 15 Minute

Price action;

Equities gapped higher on a very weak Nonfarm Payroll report as FED rate will cut now within 2 weeks and by more than 25bps.

However, having gapped higher, market sold off as FED now cutting into weakness rather than strength.

Bonds rallied hard, yield on US 10 year dropping to 4.07.

USD weakened pushing EURO & Aussie to breakout levels

Gold hits all time high above $3,500, Silver at $41

Oil collapses as economy now not strong as Trump and Powell have been telling us

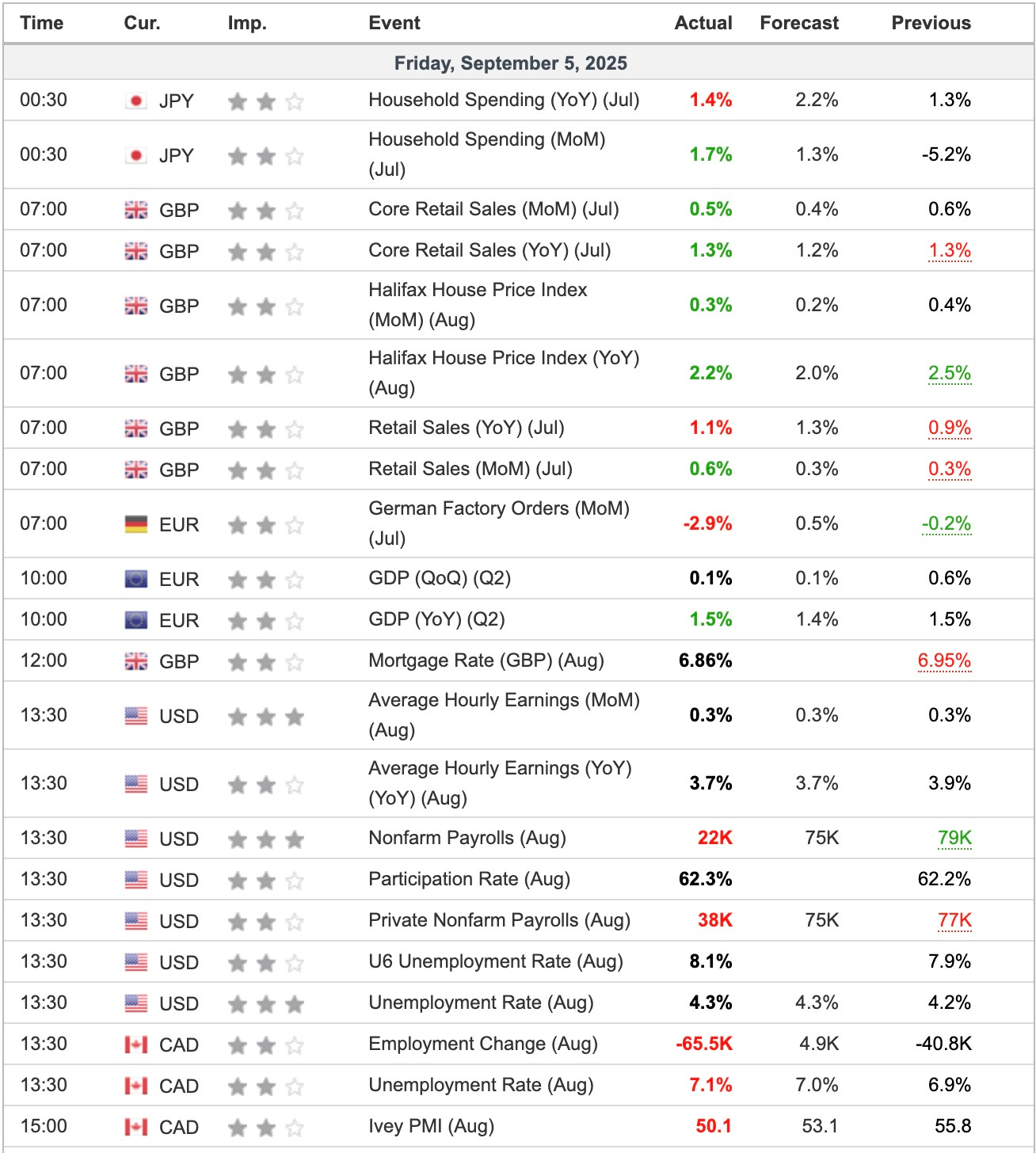

Friday's Economic Reports

Economic Indicators Released Overnight

Breaking

Treasury Secretary Bessent calls for entire review of Fed [investing.com]

Japan says US trade deal not settled, awaits pharma, chip orders [Reuters]

EU fines Google nearly €3bn for ‘abusing’ dominant position in ad tech [Guardian]

BLS Says Database Lockdown ‘Normal’ Ahead of August Jobs Report [Bloomberg]

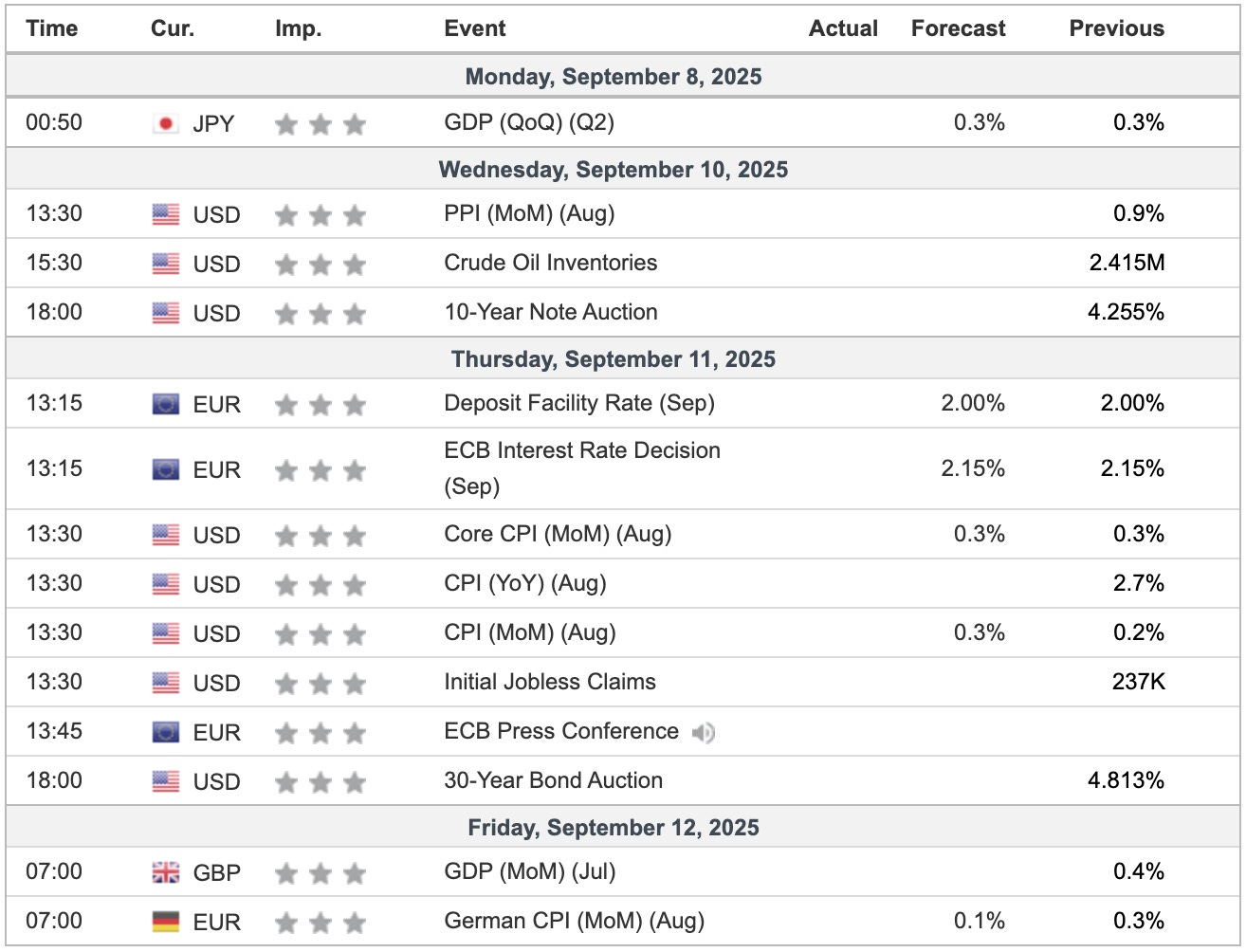

What's Next?

ECB monetary policy meeting before the FED this week after will be of key importance, along with US CPI and PPI. And US 10 and 30 year bond auctions.

Worst potential outcome would be perception of FED cutting into accelerating inflation. Those bond rallies could flip on a dime.