US Update

Nonfarm Payroll lives up to it's reputation for moving markets

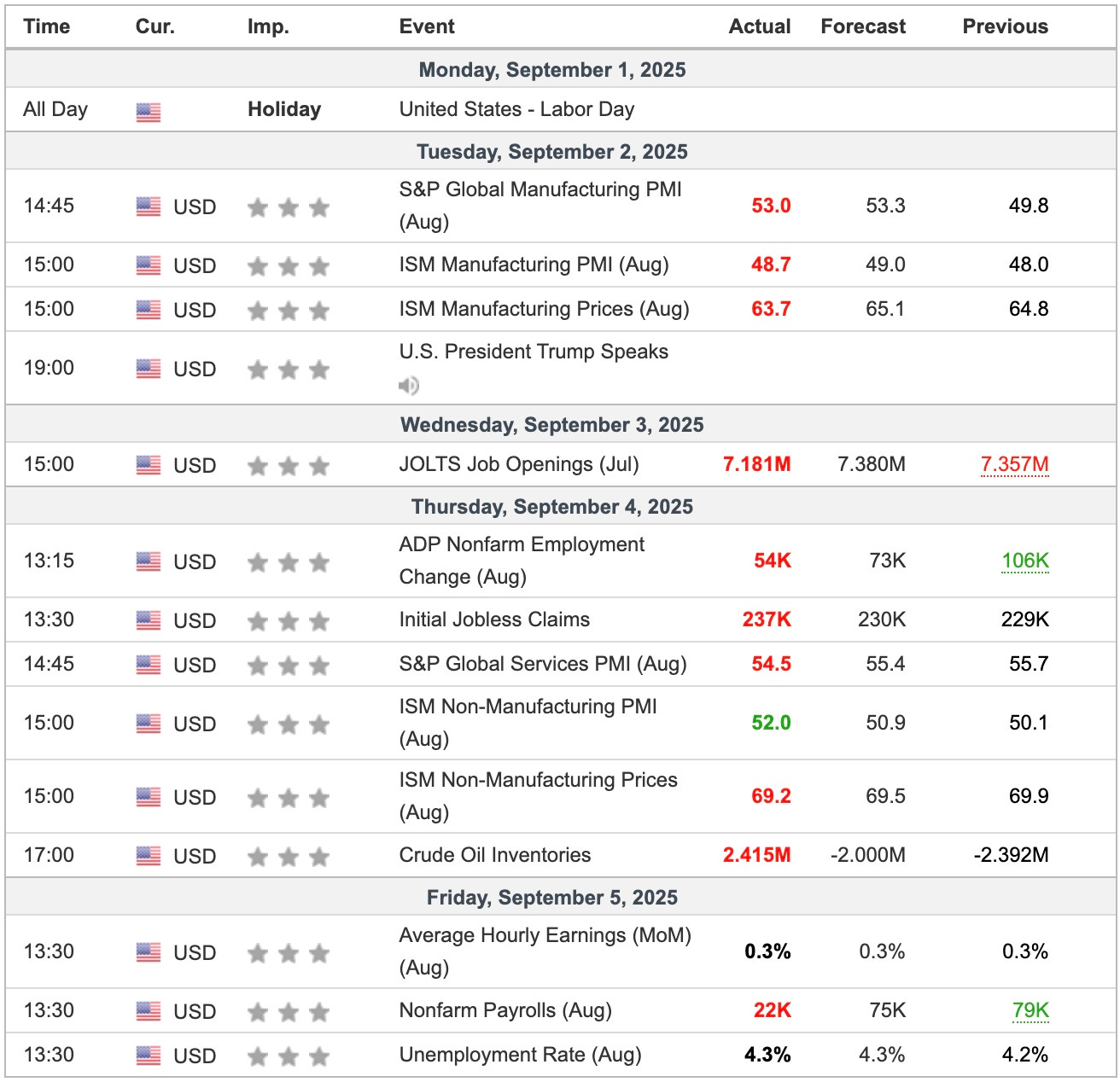

US Economic Indicators

The Nonfarm Payroll report ended a weak of poor economic data with a killer punch. Weaker manufacturing PMIs, lower job openings, Initial Jobless Claims ticking up and low ADP count and now a catastrophic NFP, particularly the monthly revisions, and with a bigger potential revision coming next week

Headline

The U.S. labor market continued to cool in August 2025, with Nonfarm Payrolls adding just 22,000 jobs—far below the Dow Jones economist consensus forecast of 75,000 and marking a significant slowdown from the revised July gain of 79,000. This meagre increase, the weakest since late 2023 outside of temporary disruptions, was largely driven by gains in health care (+31,000) and social assistance (+16,000), which accounted for nearly all net job growth. These sectors offset losses elsewhere, including federal government (-15,000), mining/quarrying/oil & gas extraction (-10,000), wholesale trade (-12,000), and manufacturing (-12,000). Broader economic headwinds, such as escalating tariffs under the Trump administration and persistent inflation pressures, appear to be dampening hiring across most industries.

Revisions

Monthly revisions to prior estimates highlighted an even softer underlying trend than initially reported. June's payroll change was revised downward by 27,000, from +14,000 to a net loss of -13,000. July's figure was adjusted upward slightly by 6,000, from +73,000 to +79,000. Combined, these revisions reduced the total job gains for June and July by 21,000 from prior reports, bringing the three-month average (June-August) down to just 29,000—a stark contrast to the 150,000+ monthly pace seen earlier in 2025. Such downward adjustments, attributed to additional business reports and seasonal factor recalculations, underscore growing survey inaccuracies amid volatile economic conditions, including trade uncertainties and federal workforce reductions. This pattern echoes larger annual benchmark revisions earlier in the year, which cut March 2024 estimates by 598,000 jobs, signalling potential overestimation in initial BLS figures.

Unemployment Rate

The unemployment rate edged up 0.1 percentage point to 4.3%, reflecting a household survey showing labor force participation dipping to 62.2% and a net decline of 260,000 employed workers. Average hourly earnings rose 0.3% month-over-month (meeting expectations) and 3.7% year-over-year (slightly below the 3.8% forecast), indicating moderating wage pressures that could ease inflationary concerns. The average workweek for private nonfarm employees held steady at 34.2 hours for the third consecutive month.

This report amplifies signals of labour market "turbulence," as described by economists, with job growth concentrated in low-wage service sectors and broader weakness raising recession risks. It bolsters expectations for aggressive Federal Reserve action, with markets now pricing in a near-certain 25-basis-point rate cut at the September 17-18 meeting (100% probability) and a 12% chance of a 50-basis-point move, per CME FedWatch data. The next report, covering September, is due October 3, 2025.

Currency

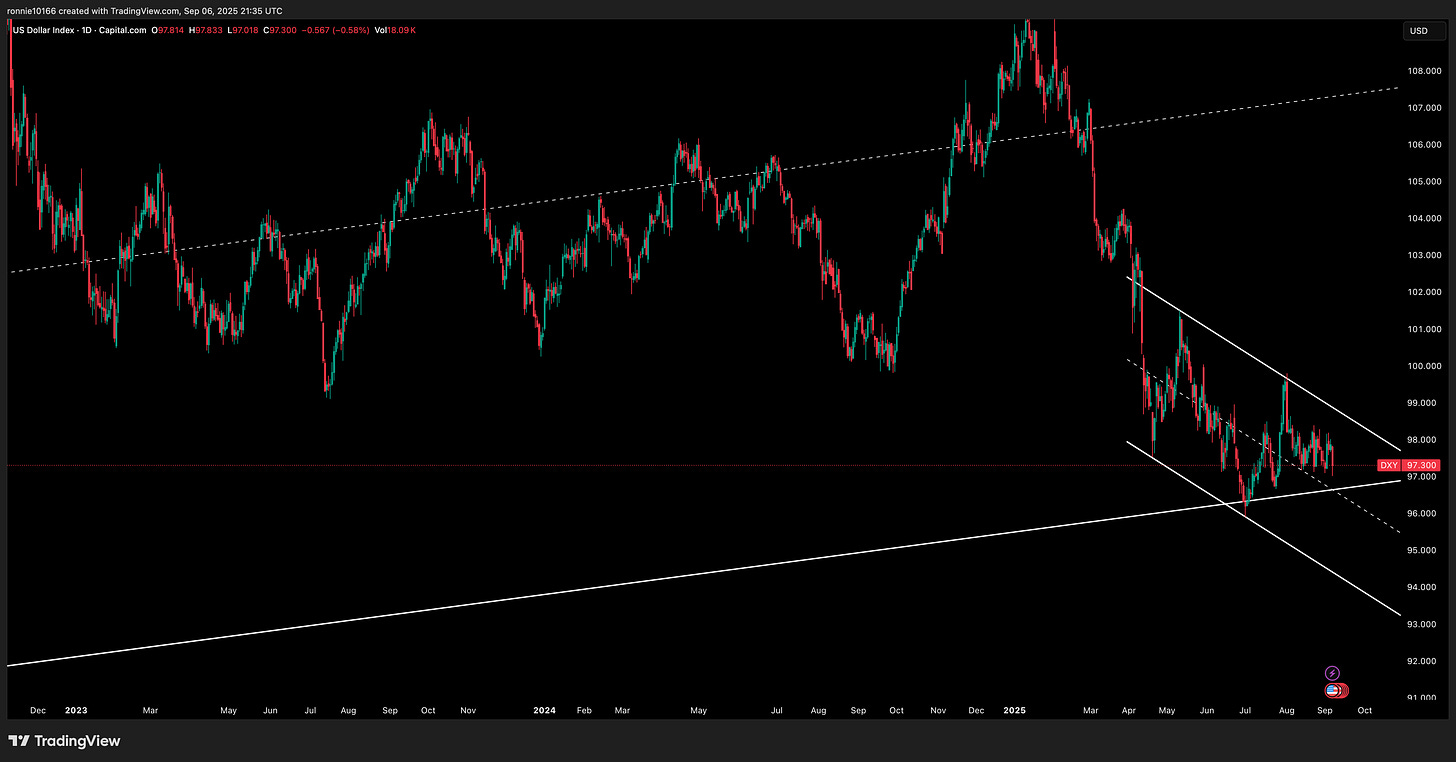

USD, via DXY, price action still poor. Yield bounced at confluence of 15 year trend and short-term trend, back in July and now the 15 year will meet the centre line of the downtrend at 96.60. We could crawl along the long-term trend further but a big move is coming to your chart soon.

DXY Daily

Yields

Yields dropped to the lower level of the immediate downtrend.

US 10 Year Government Bond Yield Daily