Markets Update 29 September 2025

It's all about Nonfarm Payroll this week

News Overnight

Markets open quiet this morning but Gold and Silver push higher, and Bitcoin is trying to break the short-term downtrend.

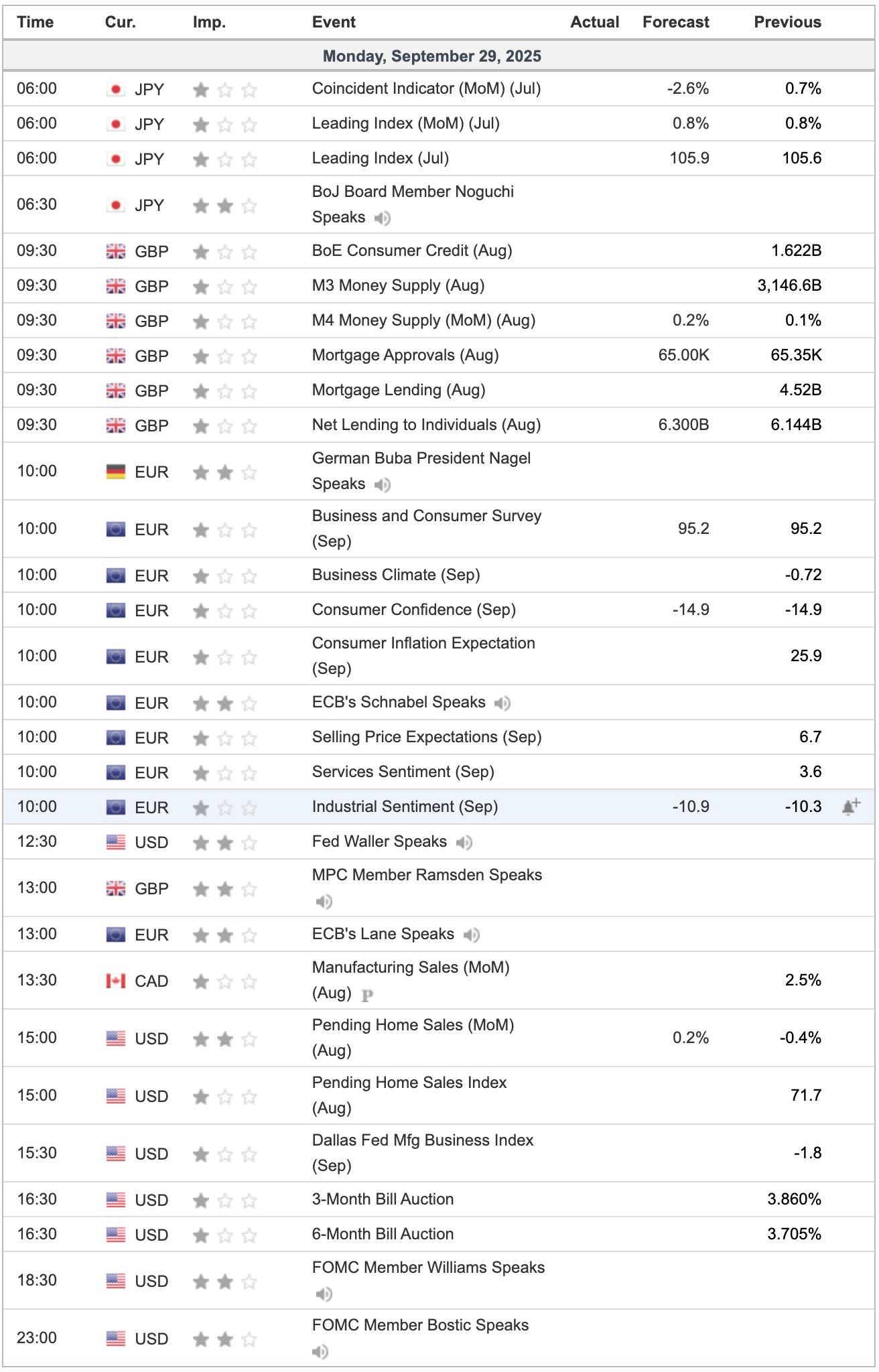

RBA tomorrow likely will hold rates, after the monthly CPI Indicator came in at 3% YoY last week. Otherwise, although there is a lot of data this week, the narrative will be around JOLTS on Tuesday, ADP on Wednesday, Initial Jobless Claims on Thursday and Nonfarm Payroll on Friday.

However, there could be disruption:

Shutdown standoff: A possible government shutdown is days away, with President Donald Trump and GOP lawmakers locked in a funding standoff with Democrats.Here’s what to expect if Congress doesn’t strike a deal before Wednesday.

Trump’s stance: Sources say the president will meet with top congressional leaders from both parties tomorrow. He canceled an earlier sit-down with Democrats and has called their demands, which centre primarily on health care policy, “totally unreasonable.”

The latest on the Trump administration as government shutdown looms [CNN]

China’s Markets Shed ‘Uninvestable’ Tag as Global Funds Return [Bloomberg]

Australia Set to Hold Key Rate as Scope for Further Easing Slims [Bloomberg]

Exclusive: OPEC+ plans another oil output hike in November, sources say [Reuters]

Britain’s Reeves set to guarantee jobs for young unemployed [Reuters]