Markets Update 24 September 2025

Powell spooks markets

Yesterday FED Chair Powell’s speech on the economy and monetary policy, was interesting for 3 reasons.

Tariffs could ultimately prove deflationary by curbing household spending and demand.

In his view, policy is “slightly restrictive”.

He flagged elevated asset valuations, including stocks

More rate cuts said the market (again), but careful because it’s not the FED’s business to comment on asset valuations unless they’re inflationary.

For Free Subscribers

For Paid Subscribers

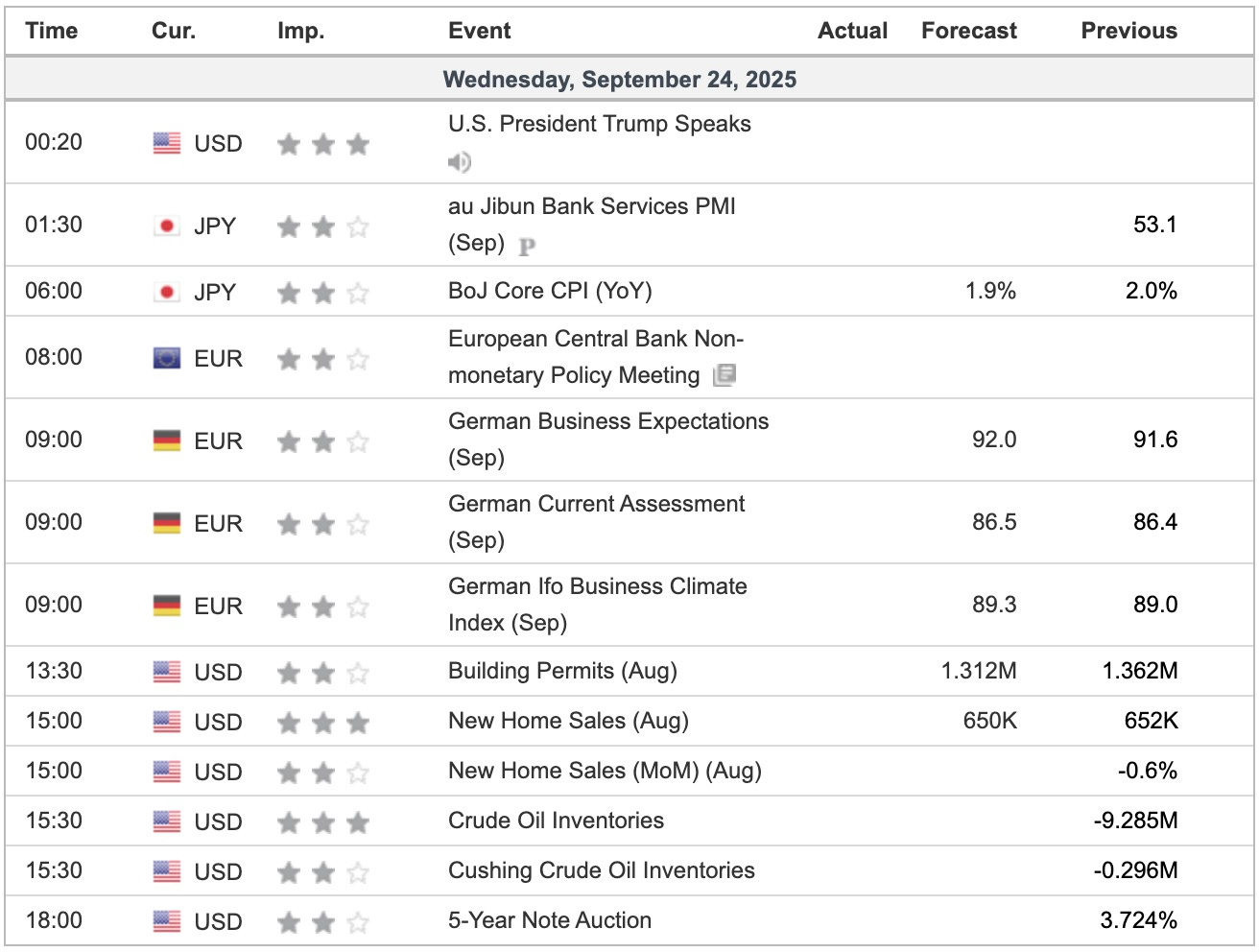

Economic Indicators Today