Limit Up! 27 October 2025

A surprise deal

News Overnight

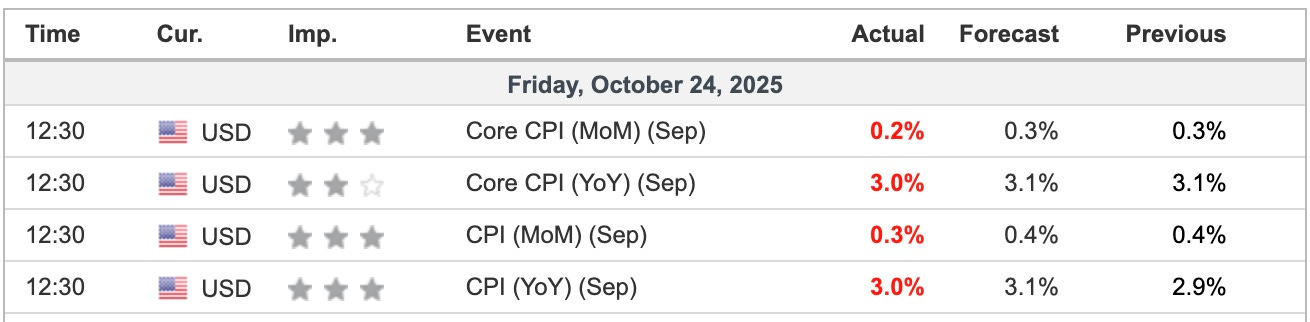

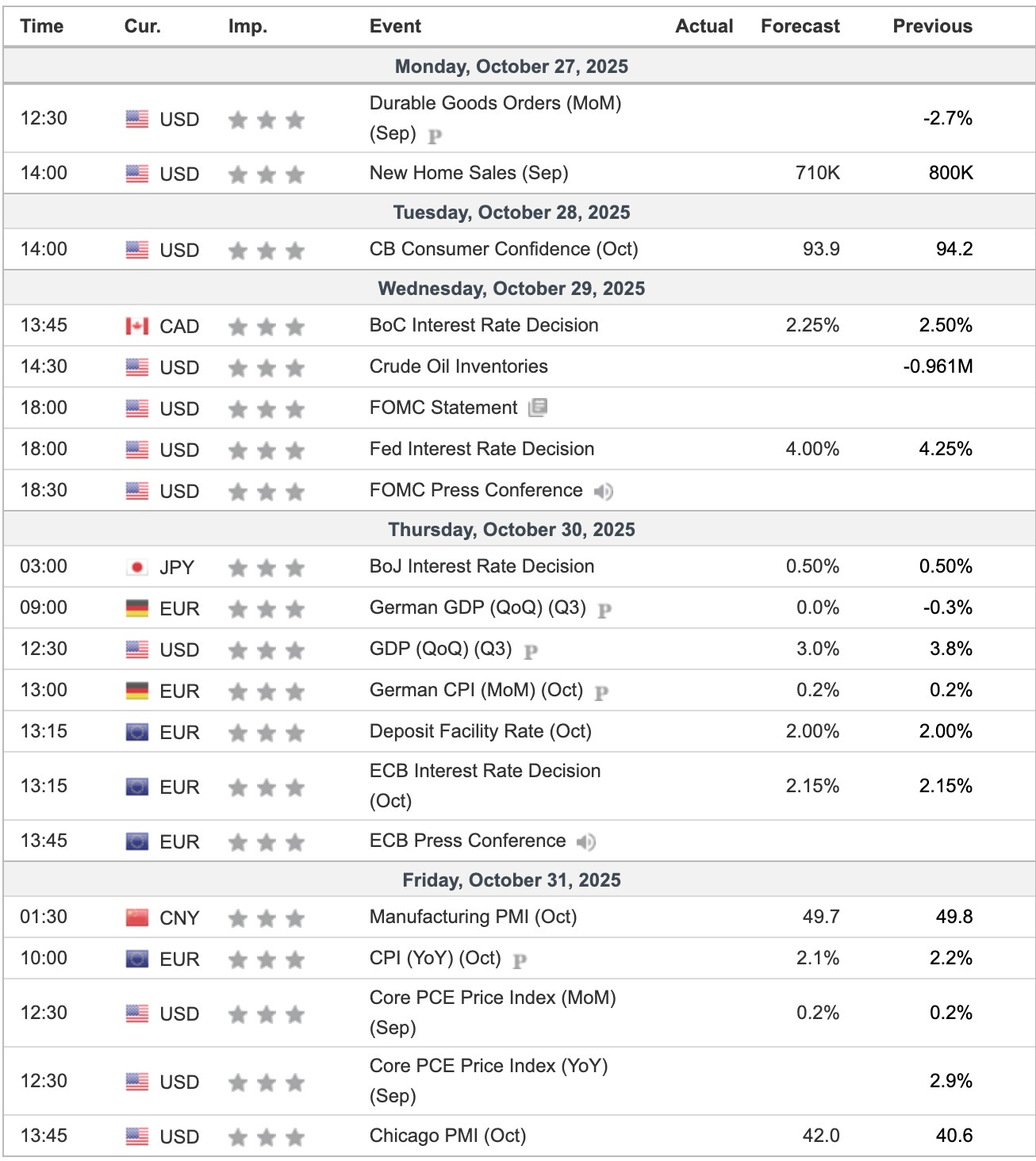

US CPI came in below expectation, just the kind of number the FED needs to cut rates. Very kind of Trump to release it and not all the others he could release.

Equities jumped and so did Bitcoin

Breaking

Japan’s Nikkei tops 50,000 mark for first time on stimulus euphoria [Reuters]

US, China Tee Up Sweeping Trade Deal for Trump, Xi to Finish [Bloomberg]

France Gets Fresh Warning on Debt as Moody’s Turns Negative [Bloomberg]

Singapore’s prime minister warns of ‘messy’ transition to post-American order [FT]

Data Center Lending Probed by BOE Amid AI Bubble Fears [Bloomberg]

China’s New Strategy for Trump: Punch Hard, Concede Little [Wall St Journal]

Trump says he’s increasing tariffs on Canada by 10% after Ontario’s Reagan ad [CNN]

Crisis-hit Porsche plunges to $1.1 billion quarterly loss [Reuters]

JPMorgan to Allow Bitcoin and Ether as Collateral in Crypto Push [Bloomberg]

For Free Subscribers

Bitcoin Update 27 October 2025

A big comeback from Bitcoin as US CPI takes away any hurdles for risk assets to rise. There are some hurdles to jump: 115.3k, 117.1k and then try for 123.3k

USD/YEN Update 27 October 2025

For Paid Subscribers

AUD/USD Update 27 October 2025

AUD/USD is absolutely glued to the 15 year trend line lower. If USD is bottoming as USD/YEN and USD/CAD now suggest, AUD/USD could return below the line and head towards 0.61 which price has visited a few times recently, but has not been below sustainably.

USD/CAD Update 27 October 2025