Financial Markets Update 9 December 2025

We're all praying for no policy errors from RBA and FED

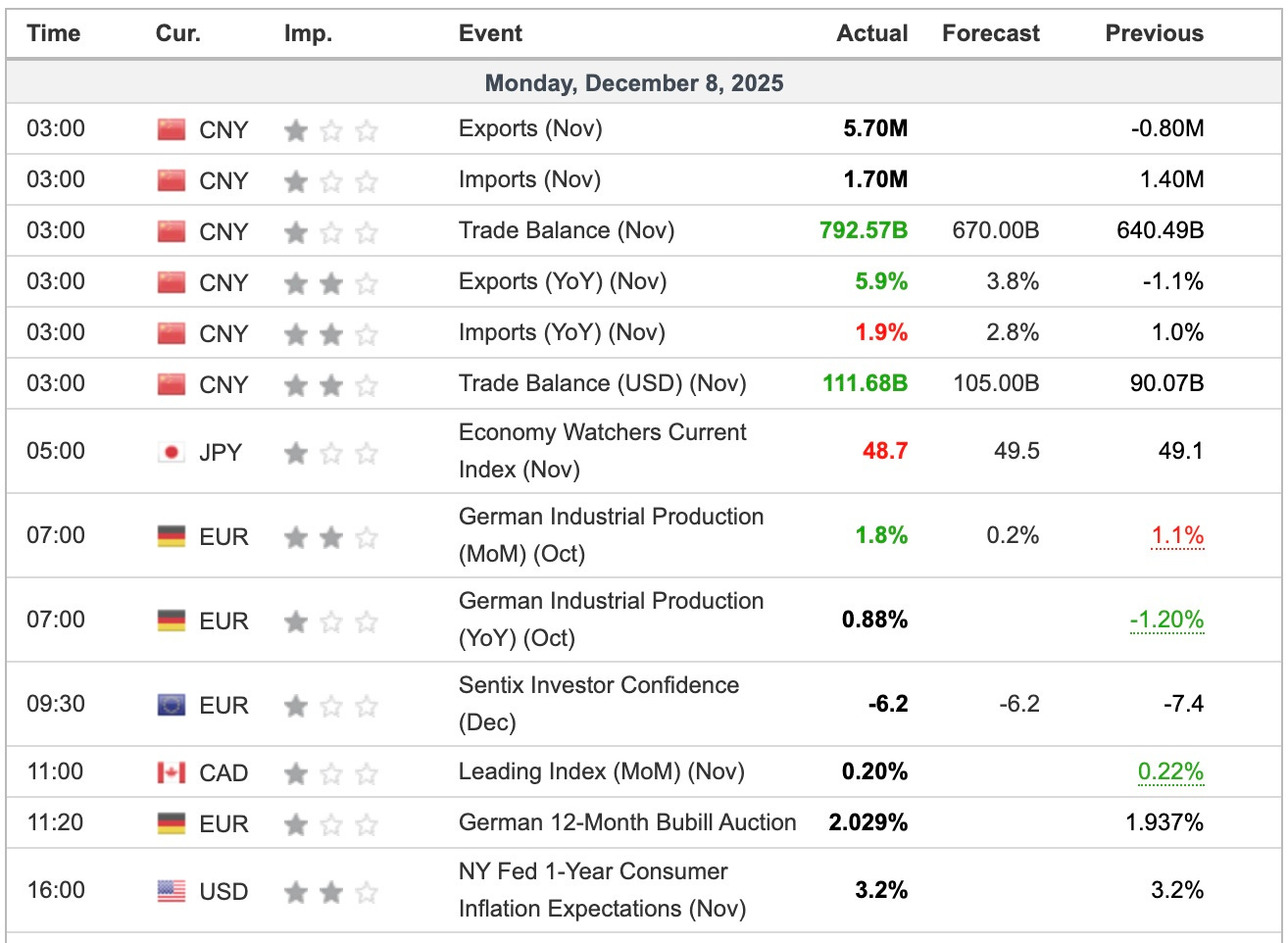

News Overnight

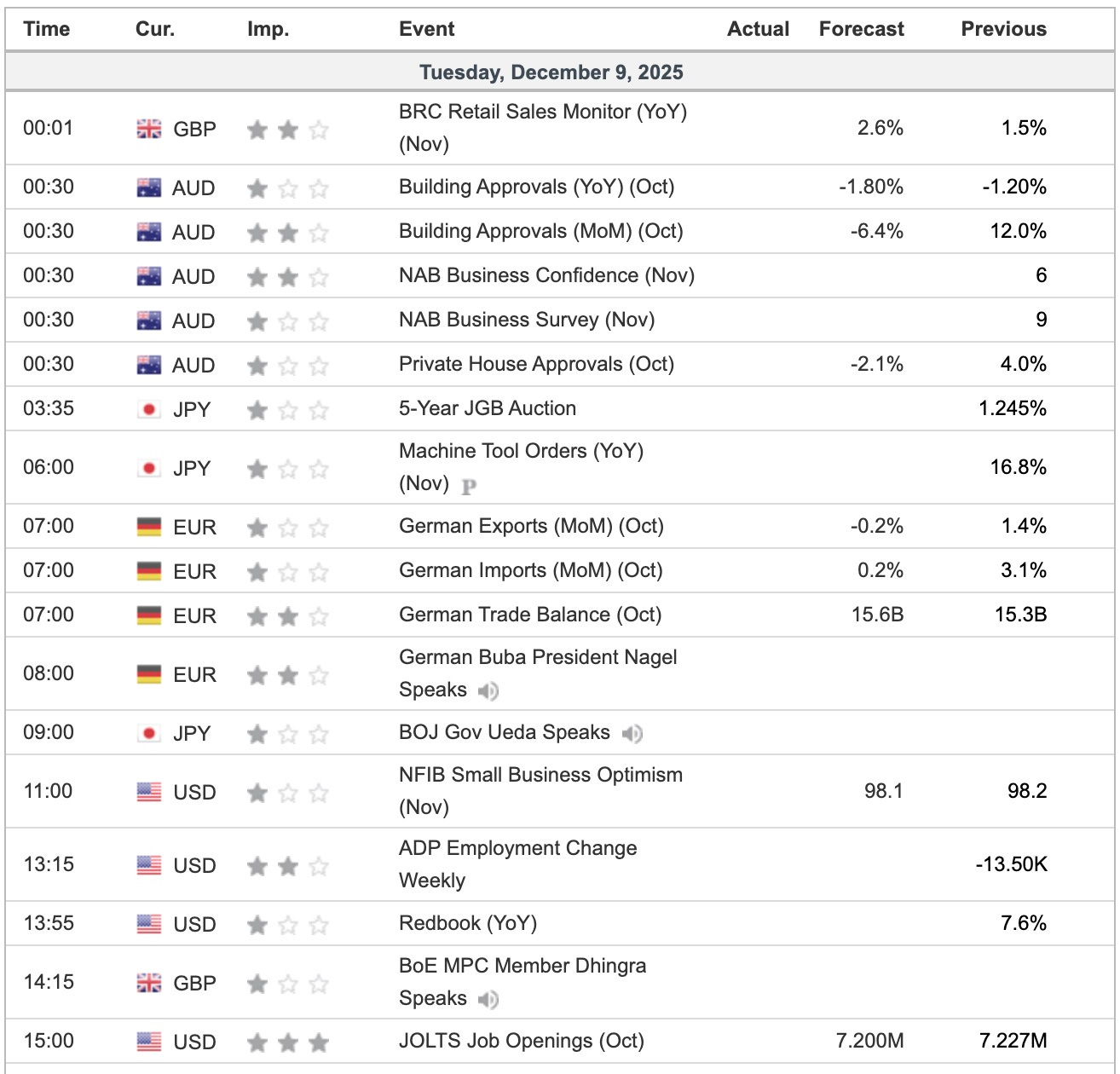

Risk assets closed lower on Monday as traders square up before the most important FOMC meeting in a generation. Another policy mistake and the global economy is in deep trouble.

China’s trade surplus is still running at USD1T per year with 25% going to the US! This train can’t stop.

Breaking

Japan frustrated at Trump administration’s silence over row with China [FT]

Trump to issue executive order for single federal rule on AI regulation [FT]

Pimco Investment Chief Warns of ‘Dangerous’ Credit-Ratings Dynamic [Bloomberg]

US stocks end lower as investors wait for Fed rate decision [Reuters]