Financial Markets Update 8 December 2025

Certain US rate cut. Certain RBA rate hold

News Overnight

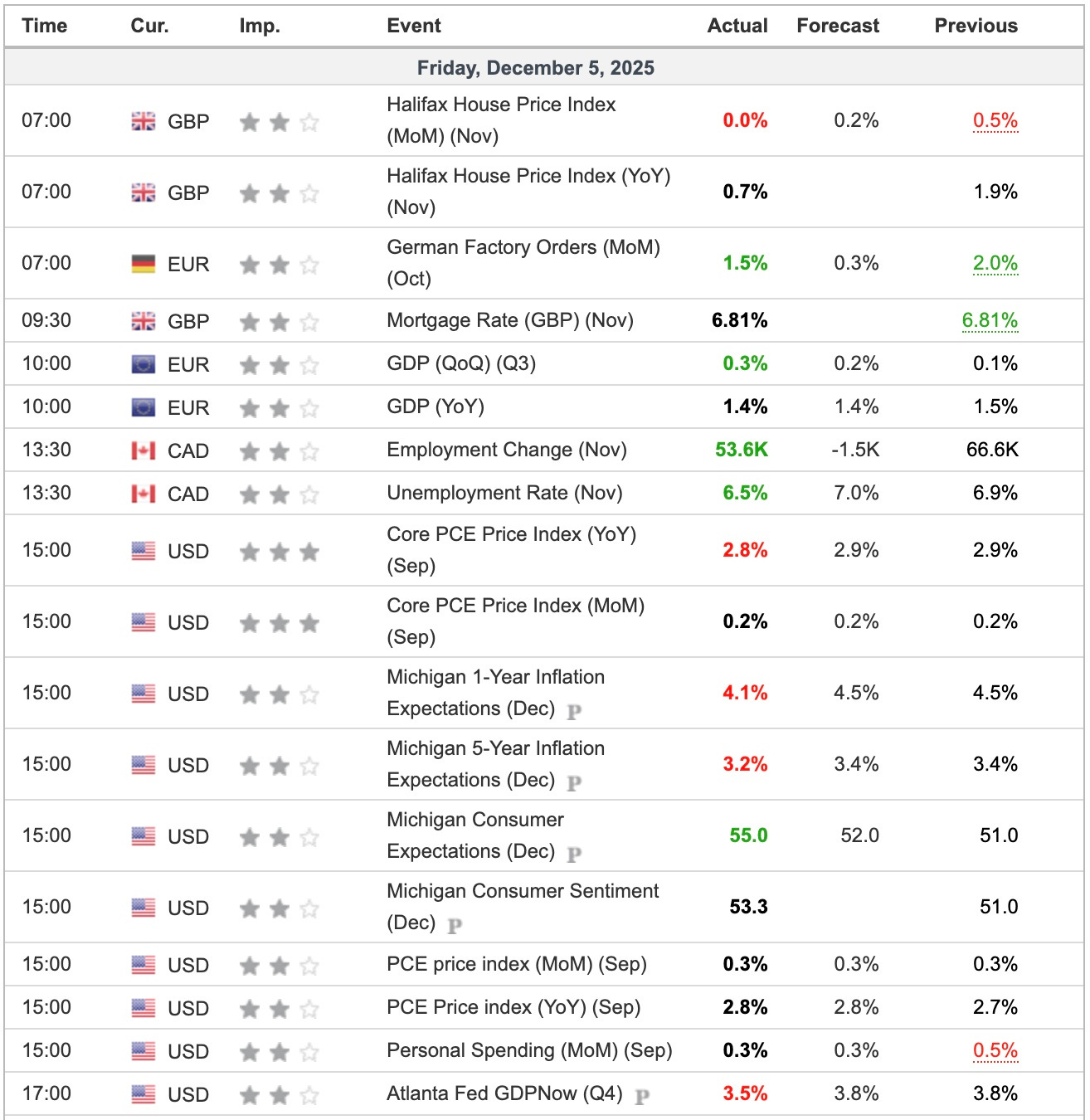

More inside trading right from the very top, saw risk assets spike just before PCE was released, only to go lower afterwards. It’s only a matter of time before market makers decide to abandon the sinking ship.

No matter, markets drifted for a lot of Fridays session, as the Silver fight at $60.00 drew all the attention.

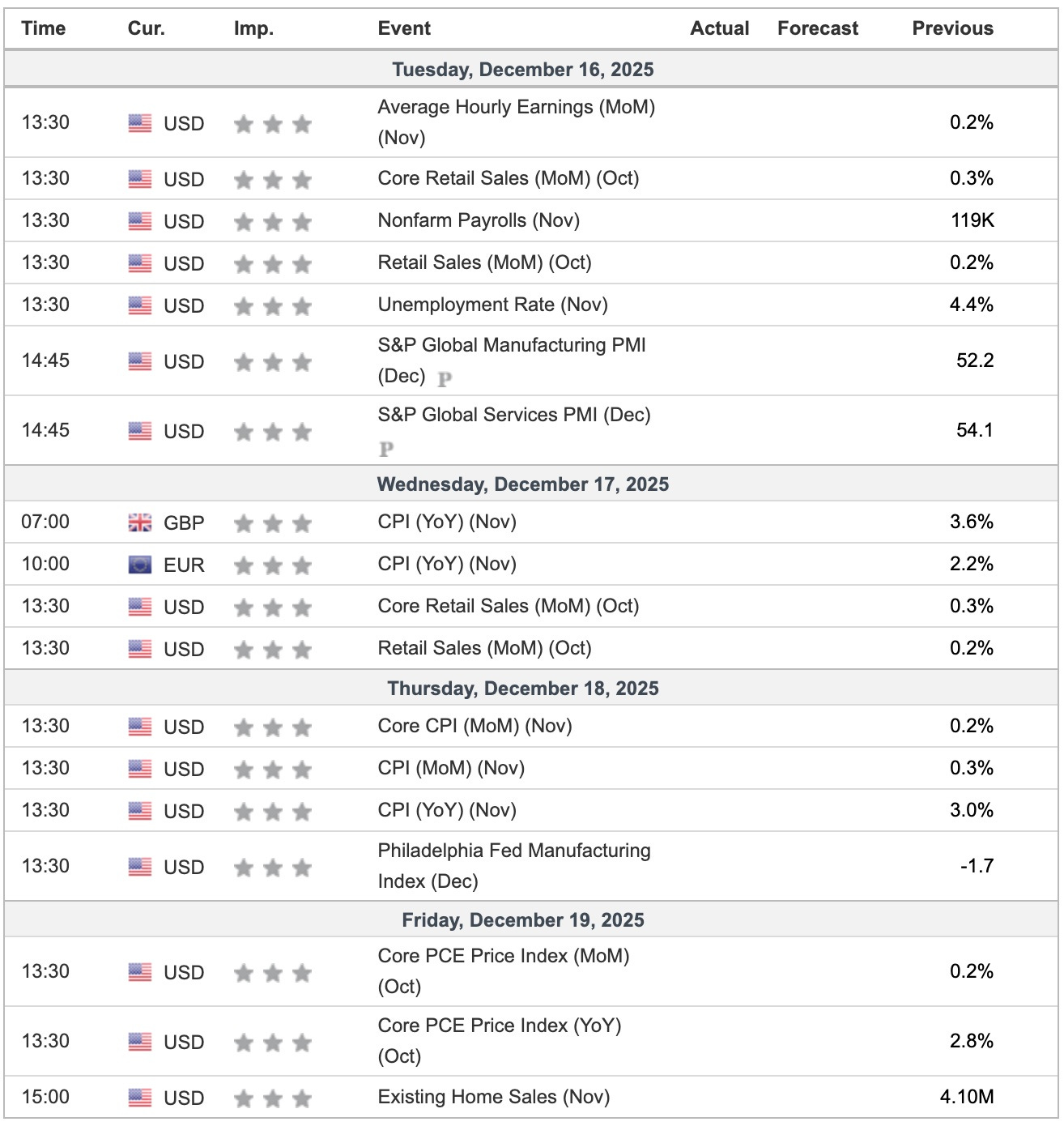

RBA tomorrow and the FED Wednesday will have markets on their toes, but if it all goes as it almost certainly will, the run down before Xmas begins.

Breaking

Fed expected to cut rates despite deep divisions over US economic outlook [FT]

China and Japan need to take a step back from the brink [Asia Times]

The BRICS Gold-Backed UNIT Has Been Successfully Launched [Zerohedge]

Brussels pushes for 70% of critical goods content to be ‘made in Europe’ [FT]

EU could announce package to support auto industry on December 16, industry source says [Reuters]

For Free Subscribers

For Paid Subscribers

Country Updates

Australia Update 8 December 2025