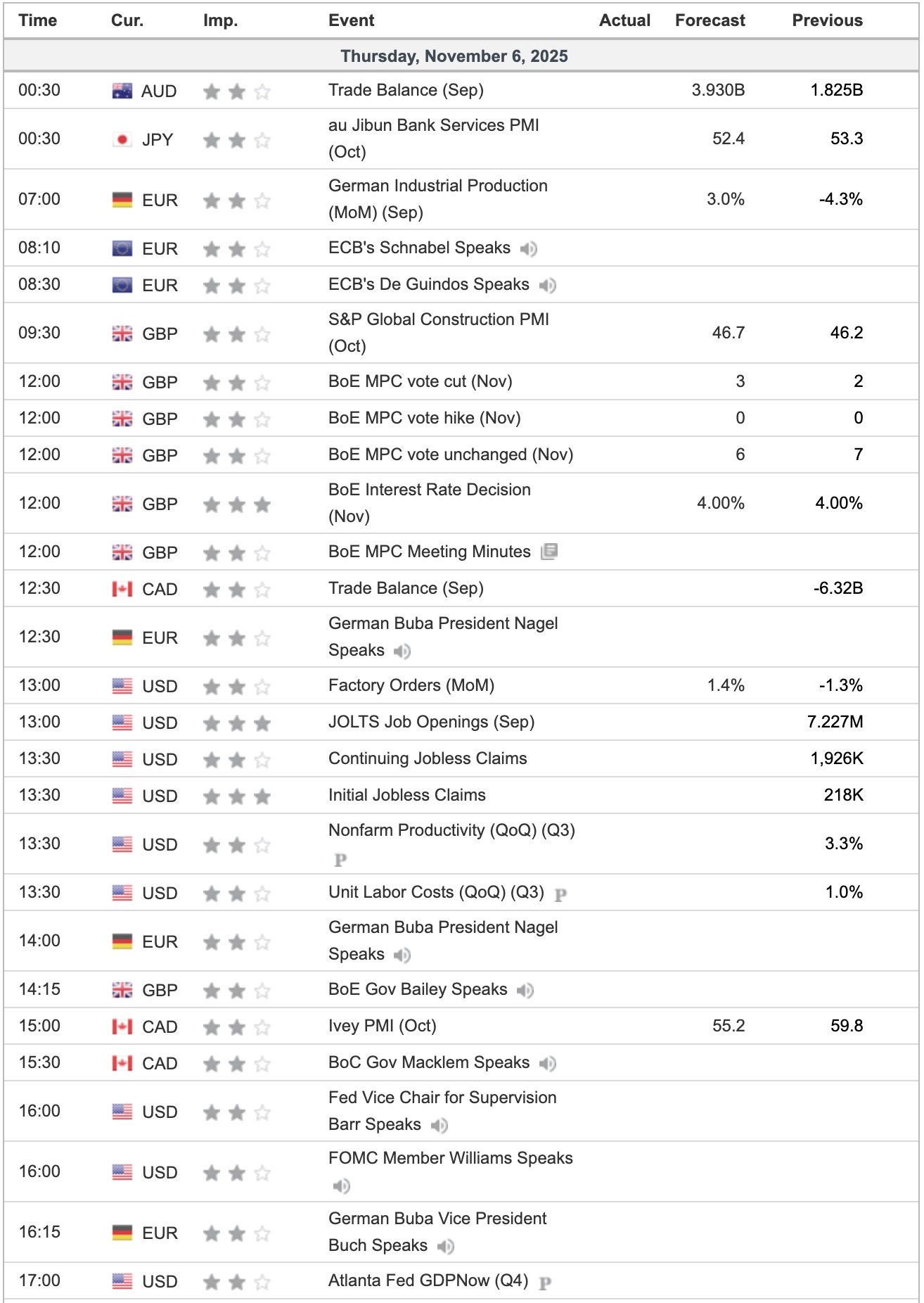

Financial Markets Update 6 November 2025

Wild swings overnight

News Overnight

Wild swings in markets as Bitcoin and Asian equities had massive liquidations but focus moving to the supreme court fiasco as the day went on. No follow through from London and New York and prices bounced.

What data we could glean from the US economy was a better than expected ADP report but still at a very low level. The Non-Manufacturing PMIs were encouraging but not relevant to price.

Breaking

Wall Street rebounds as solid data, strong earnings offset valuation concerns [Reuters]

South Korea halted KOSPI equity index futures trade after a 5% drop [TradingView]

Japan’s Nikkei 225 slumps 4%, led by losses in tech sector [Japan Times]

Shutdown could close some US airspace, airline stocks fall [Reuters]

US private sector employers added 42,000 jobs in October [FT]

Supreme Court Appears Skeptical of Trump’s Global Tariffs [Bloomberg]

For Free Subscribers

For Paid Subscribers

Bitcoin Update 6 November 2025