Financial Markets Update 5 November 2025

Markets start fraying

News Overnight

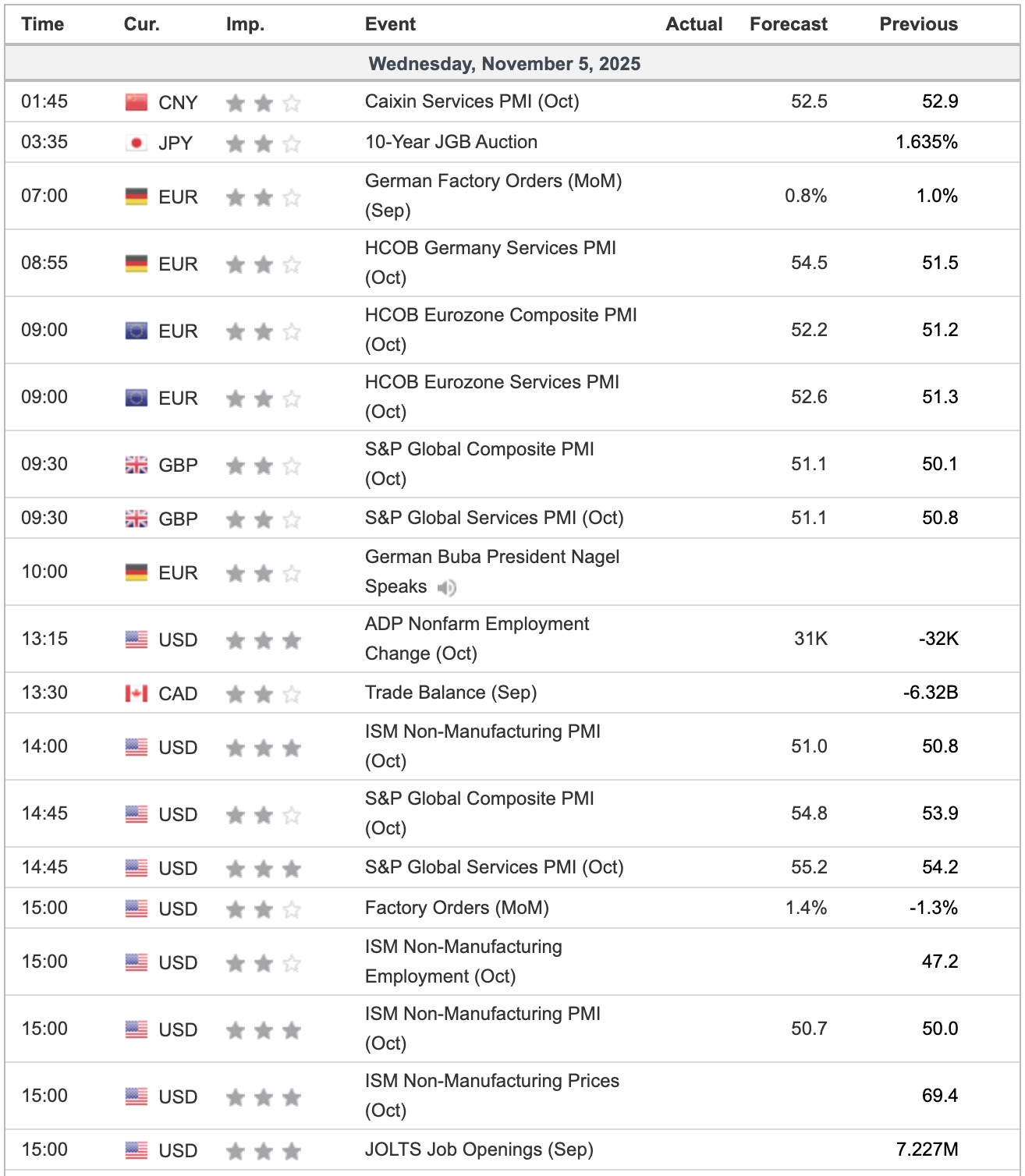

Economics totally in the background with only the RBA hold of any interest.

RBA holds official interest rate at 3.6% while warning of rising house prices and rents [The Guardian]

Statement by the Monetary Policy Board: Monetary Policy Decision [RBA]

The fragility of markets is showing up with Bitcoin leading equities down. Continuing perceived distress in the banking system, headline news on Oracle’s credit default swaps price along with private credit and private equity warnings leave markets fearful.

US Equities fell but it wasn’t a rout. Yet.

Breaking

S&P 500 falls after Wall Street CEOs warn on valuations [investing.com]

Katayama Warns on Currency After Yen Hits Fresh 8-Month Low [Bloomberg]

China’s Central Bank Returns to Bond Market With Small Purchases [Bloomberg]

UBS chair warns of ‘looming systemic risk’ from private credit ratings [FT]

Oracle’s credit default swaps rise as AI investments grow [investing.com]

Fed’s Daly says she backed latest rate cut, open to another one in December [Reuters]

US government heads to longest shutdown as Trump resists calls to talk [FT]

For Free Subscribers

For Paid Subscribers

Bitcoin Update 5 November 2025