Financial Markets Update 4 November 2025

On the cusp of a big change

News Overnight

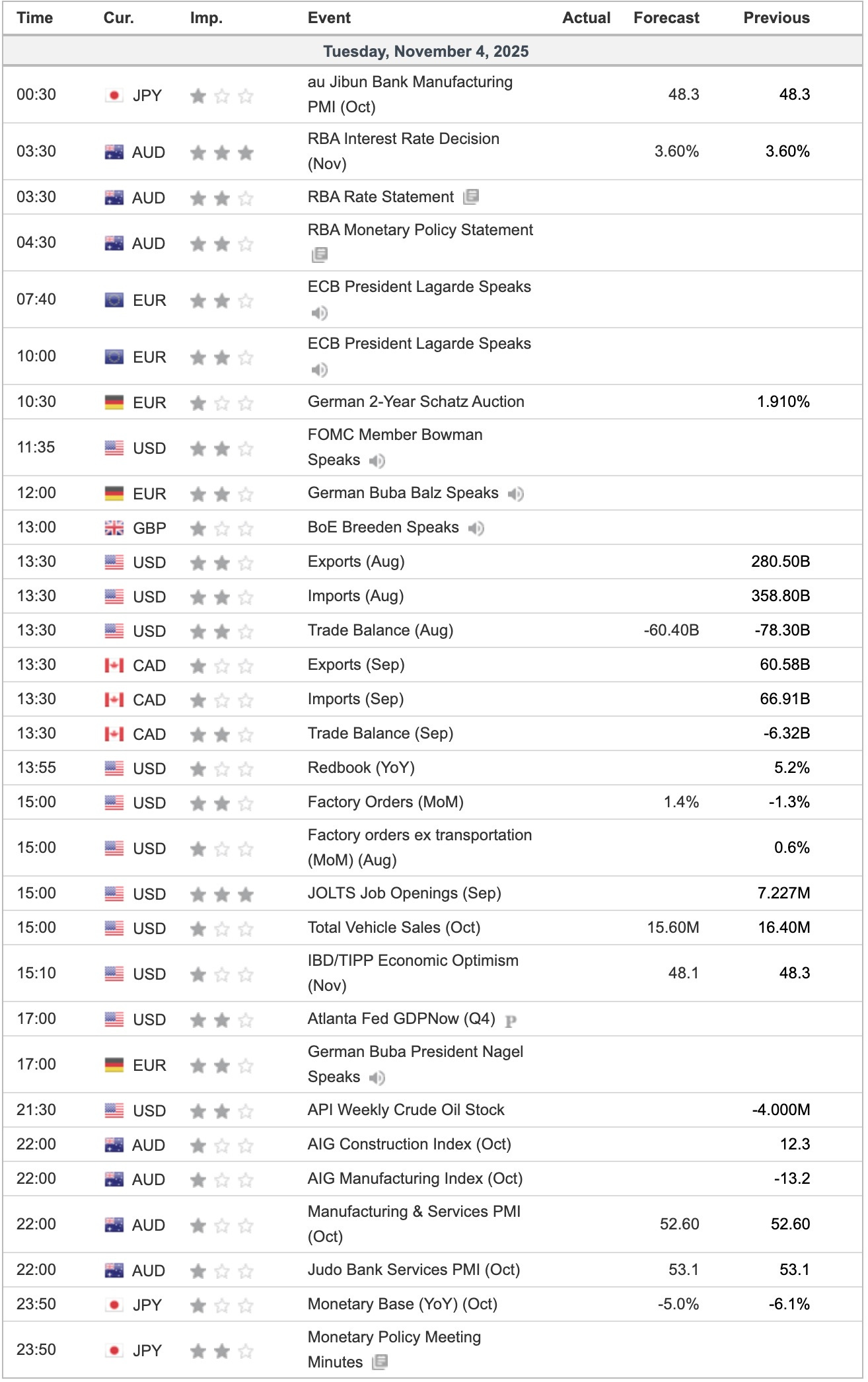

A lot of noise overnight data-wise but markets are running on FED/Credit/Banking system. Thus, aside from AI news, things took a very flat tone.

The next direction for markets could be the next move for the USD. The DXY has spent 3 months banging along the bottom of a uptrend since 2011. Markets are short USD. Dedollarisation involves buying USD to repay USD bonds before refinancing. The FED’s 2 recent cuts seem to have confirmed the bottom is in. USD/YEN and USD/CAD already left the station.

The next move up could be really painful.

Breaking

China Pays Interest in Gold Now [MSN]

Why the RBA’s rate decision will make inflation only worse [AFR]

Fed’s Cook signals December rate cut is not a foregone conclusion [FT]

A Wave of US Layoffs Flash Early Warning Sign for Job Market [Bloomberg]

Surprise Swiss inflation dip not enough to warrant central bank action, analysts say [Reuters]

For Free Subscribers

For Paid Subscribers

Silver Update 4 November 2025

Bitcoin Update 4 November 2025