Financial Markets Update 31 October 2025

Powell's presser comes home to roost

News Overnight

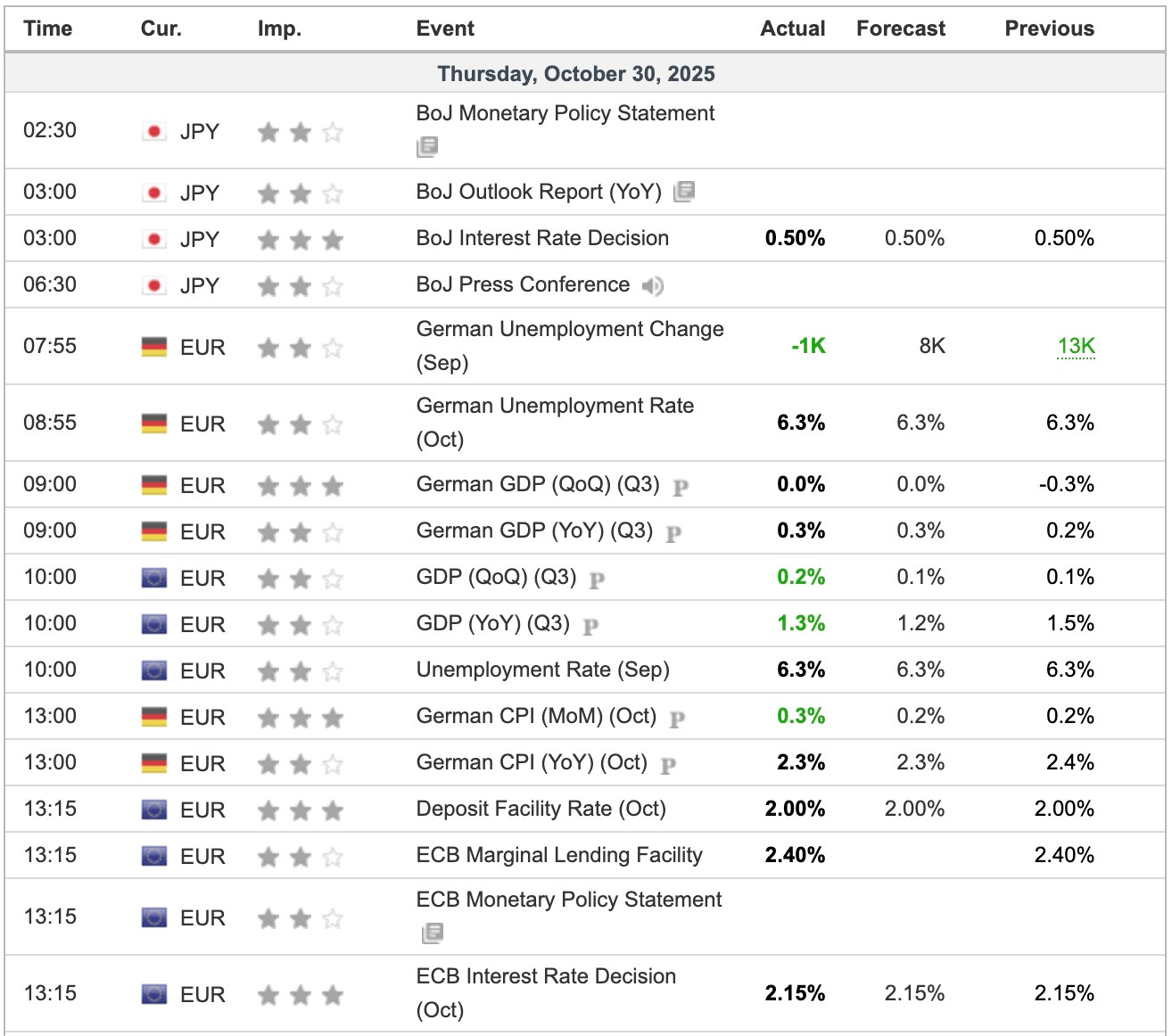

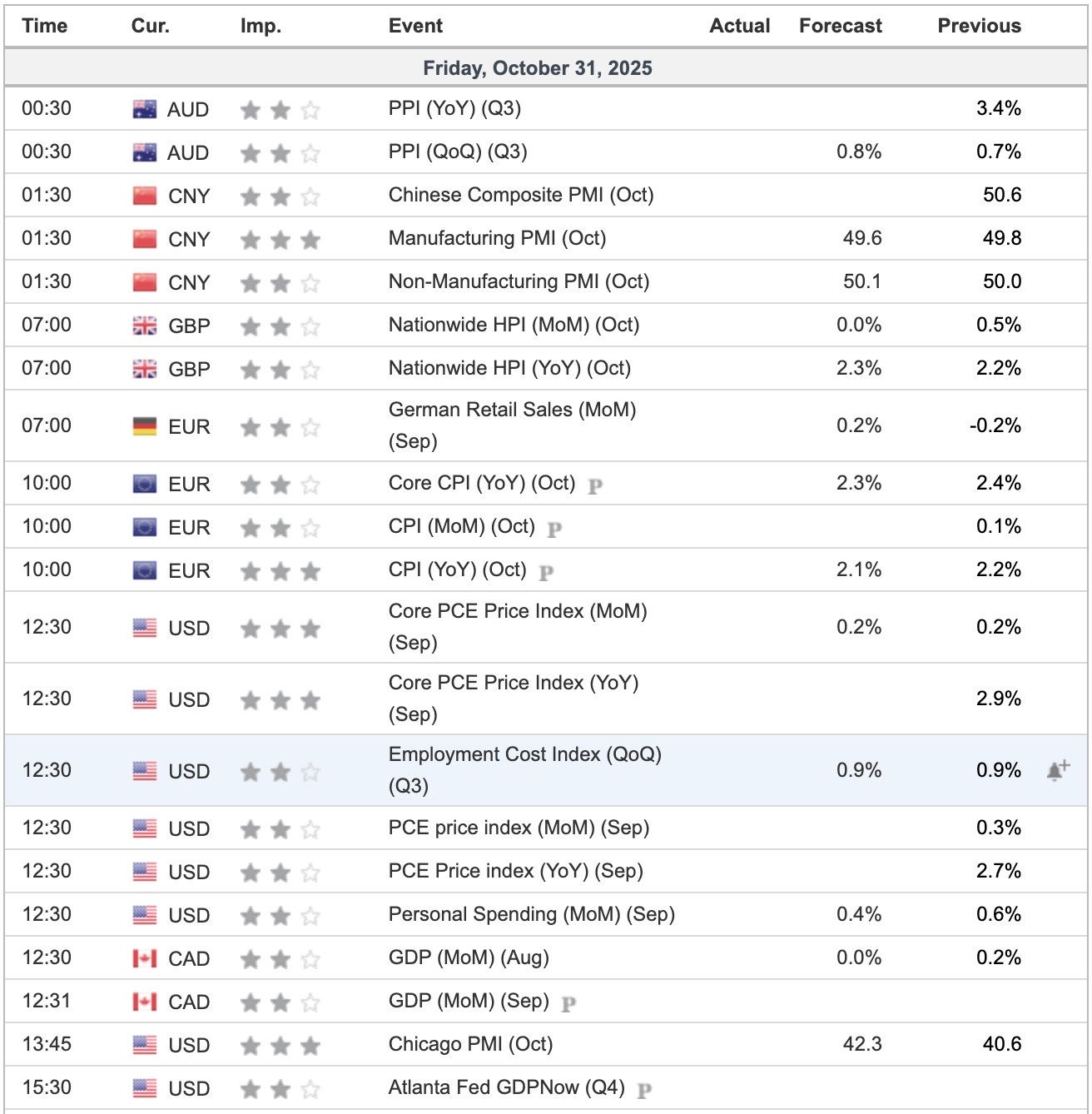

A busy day in markets as the Bank of Japan surprised no-one by keeping rates unchanged, as did the European Central Bank.

Madame Lagarde emphasised that the ECB Asset Purchase Programme (APP) and Pandemic Emergency Purchase Programme (PEPP) portfolios are declining at a measured and predictable pace, with no reinvestment of principal payments from maturing securities, in stark contrast to the FED pivoting to QE. View ECB Statement

Otherwise the tone was negative as Powell’s hawkish presser, and earnings misses by tech stocks, turned sentiment sour. Meta, in particular, got smashed, dropping 10%. Bitcoin followed.

The USD was stronger, particularly again the YEN and rates ticked higher.

Bank of Japan: Statement on Monetary Policy [BoJ]

Bank of Japan: Outlook for Economic Activity and Prices (October 2025) [BoJ]

S&P 500 falls as big tech sags amid mixed earnings [investing.com]

Breaking

US and China agree one-year trade truce after Trump-Xi talks [FT]

Trump administration quietly pays overdue WTO fees [FT]

Pentagon Orders National Guard to Establish Quick-Reaction Forces for Civil Unrest, Riots [Wall St Journal]

Toyota says it did not explicitly promise Trump new $10 billion investment in US [Reuters]

Four Senate Republicans vote with Democrats in effort to end Trump tariffs on Canada [CNN]

Big Banks Are Fighting a New $10 Million FDIC Cap [Wall St Journal]