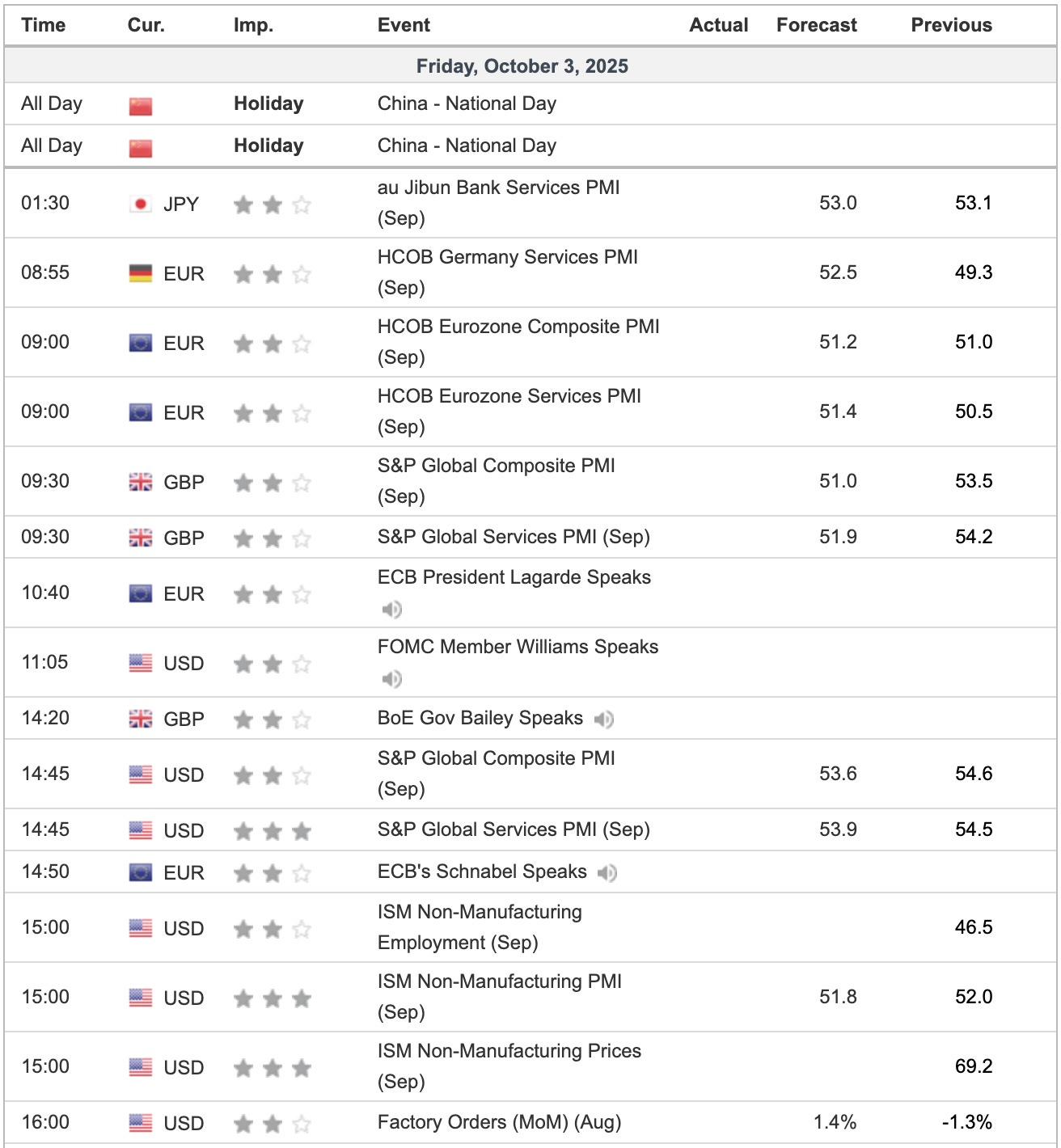

Financial Markets Update 3 October 2025

Bitcoin hits $120k as Gold and Silver consolidate

News Overnight

With Initial Jobless Claims and Nonfarm Payroll removed, traders didn’t know what to do so they didn’t do anything. Retail helped stock markets by the close and non-sovereign assets were yet again, the flavour of the day.

In Australia:

Exports Decline: Total goods exports dropped 7.8% MoM to approximately A$43.5 billion (estimated), with notable weakness in iron ore (-12% due to lower volumes and prices), coal (-5%), and natural gas (-3%). Key markets like China and Japan saw reduced shipments amid global economic slowdown concerns.

Imports Rise: Goods imports increased 2.6% to around A$41.7 billion, fueled by higher capital goods (machinery up 4%) and consumer goods (electronics up 3%), reflecting domestic demand recovery post-rate cuts by the Reserve Bank of Australia.

Services Trade: Not reported monthly; quarterly data from June 2025 showed a services surplus of A$5.2 billion, contributing to the overall goods-and-services balance.

Wall Street closes with records as tech support offsets labor, shutdown uncertainties [Reuters]

Breaking

Israeli military stops nearly all boats in aid flotilla, sparking global protests [Reuters]

Treasury Secretary Bessent says U.S. GDP could take a hit from the government shutdown [CNBC]

US government shutdown negative for credit rating, Europe’s Scope warns [Reuters]