Financial Markets Update 3 December 2025

Markets pause after clickbait overload

News Overnight

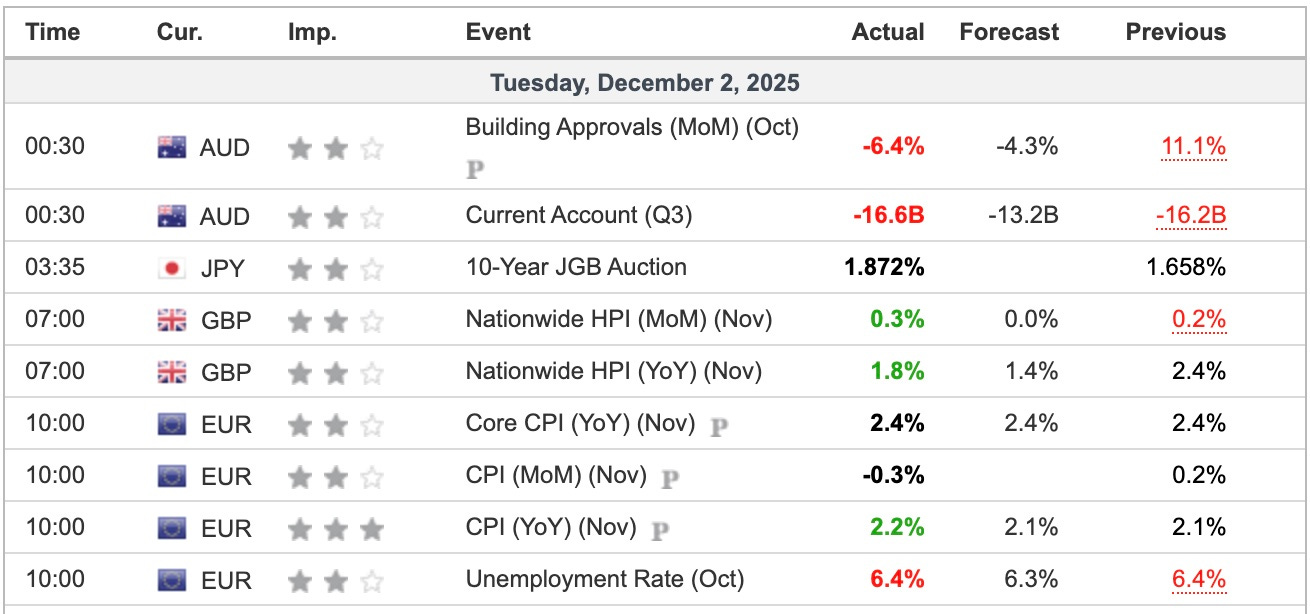

EU CPI came in slightly higher than expected but nothing to worry about.

Better to worry about the FED’s Standing Repo Facility. We ignored the end of October higher short rates and increased Repo usage. However it does now appear to be becoming a consistent feature.

10-Year Japanese Government Bond (JGB) Auction Results - December 2, 2025

The auction for the 10-year JGB (Issue Number 380) was held on December 2, 2025, and showed strong demand, with a bid-to-cover ratio of approximately 3.59 (calculated from competitive bids of 7,039.7 billion yen against accepted bids of 1,960.2 billion yen). This contributed to a decline in the benchmark 10-year yield following the auction, dropping around 2-3 basis points to approximately 1.855%.

So the doomers will have been disappointed by the Japanese auction and also by equities bouncing back.

Breaking

ECB refuses to provide backstop for €140bn Ukraine loan [FT]

Demand for Japanese bonds reassures jittery markets [FT]

OBR report says Budget leak error also led to early Spring Statement access [FT]

China Tells Stats Providers to Halt Home Sales Data Publication [Bloomberg]

Canada agrees to join EU initiative to surge defense spending [Reuters]

Mark Carney says decades-long relationship between US and Canada has ended [MSN]

Did A German Court Just Shatter One Of The Biden Era’s Biggest Lies [Zerohedge]