Financial Markets Update 29 October 2025

Train nearing full speed

News Overnight

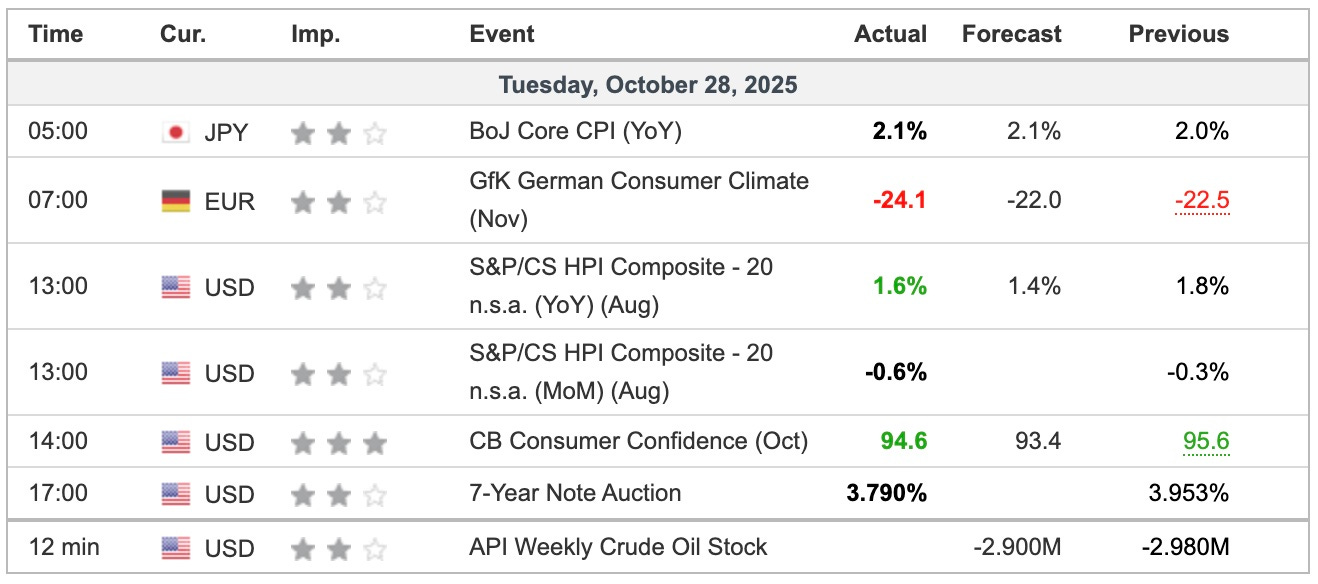

The only thing of note economically overnight was Bank of Japan Core CPI coming as expected at 2.1% YoY. This is more evidence that CPI is contained and is actually going lower. The hawks at the BoJ and MoF won’t think that and Thursday’s monetary policy meeting outcome will be interesting.

Equities continued to drive higher, proving all the talking heads wrong yet again. Let’s check back at the end of the week to see if the train is still on the rails.

Breaking

China Vows Significant Boost to Consumption Share of Economy [Bloomberg]

Private loan credit ratings may be ‘systematically’ inflated, warns BIS [FT]

Japan’s new economy minister says weak yen has benefits to growth [investing.com]

Trump floats Treasury secretary Scott Bessent as new Fed chair

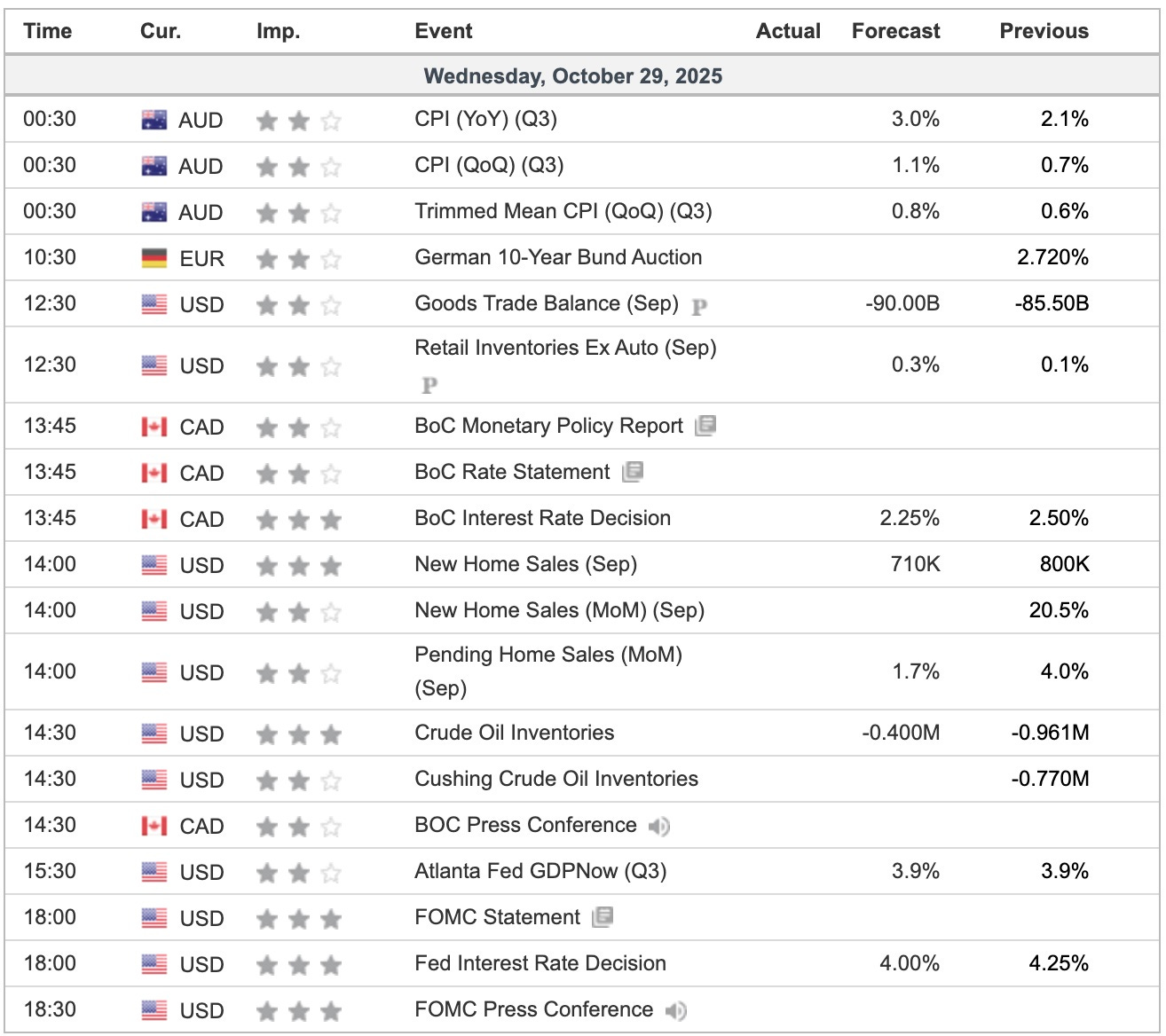

Rate cut hopes dashed after RBA’s blunt inflation message [AFR]

South Korea’s Housing Market Is a ‘Ticking Bomb,’ President Says [Bloomberg]

For Free Subscribers

For Paid Subscribers

Bitcoin Update 29 October 2025

USD/YEN Update 29 October 2025