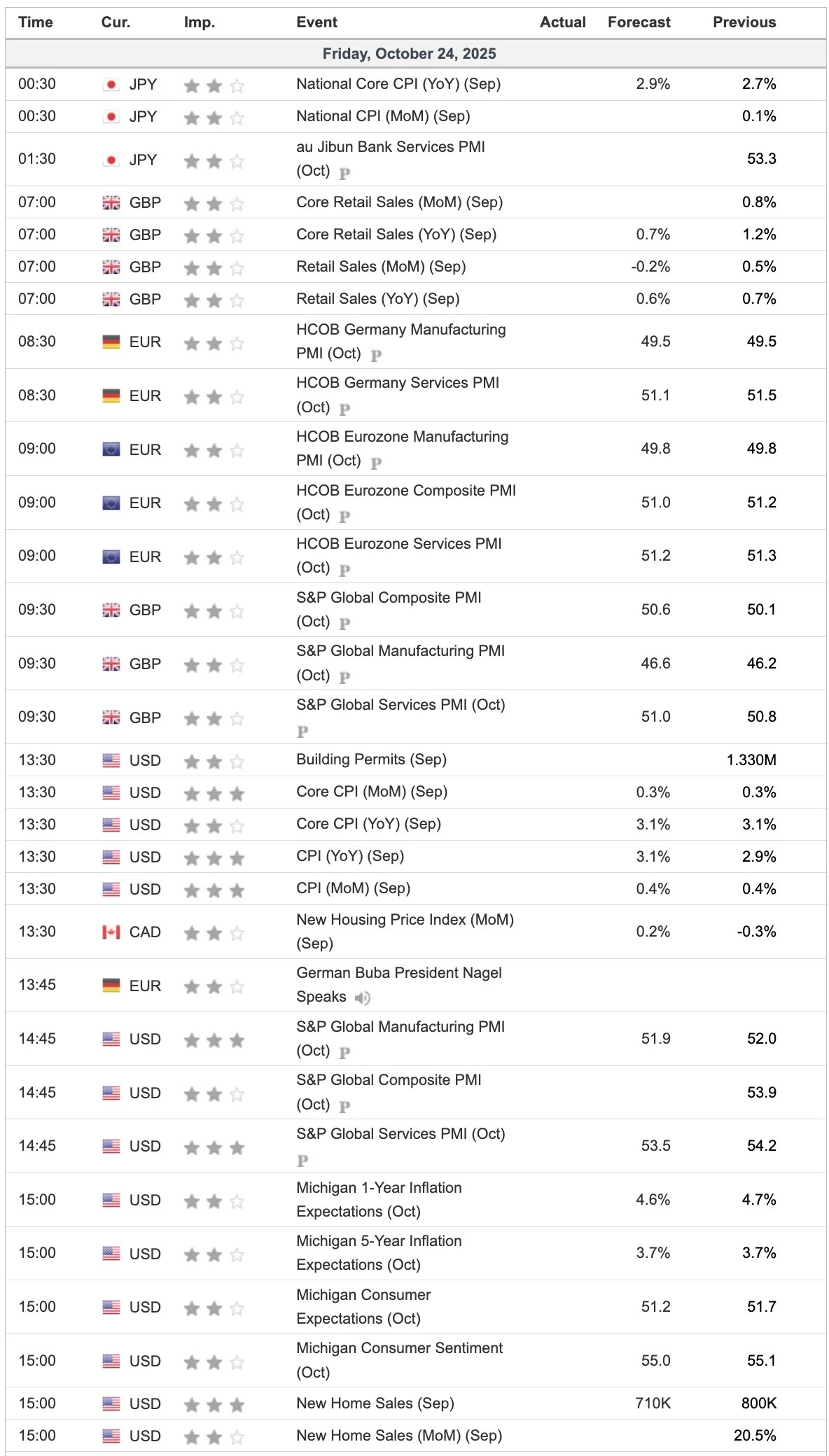

Financial Markets Update 24 October 2025

Oil spikes as US front runs sanctions

News Overnight

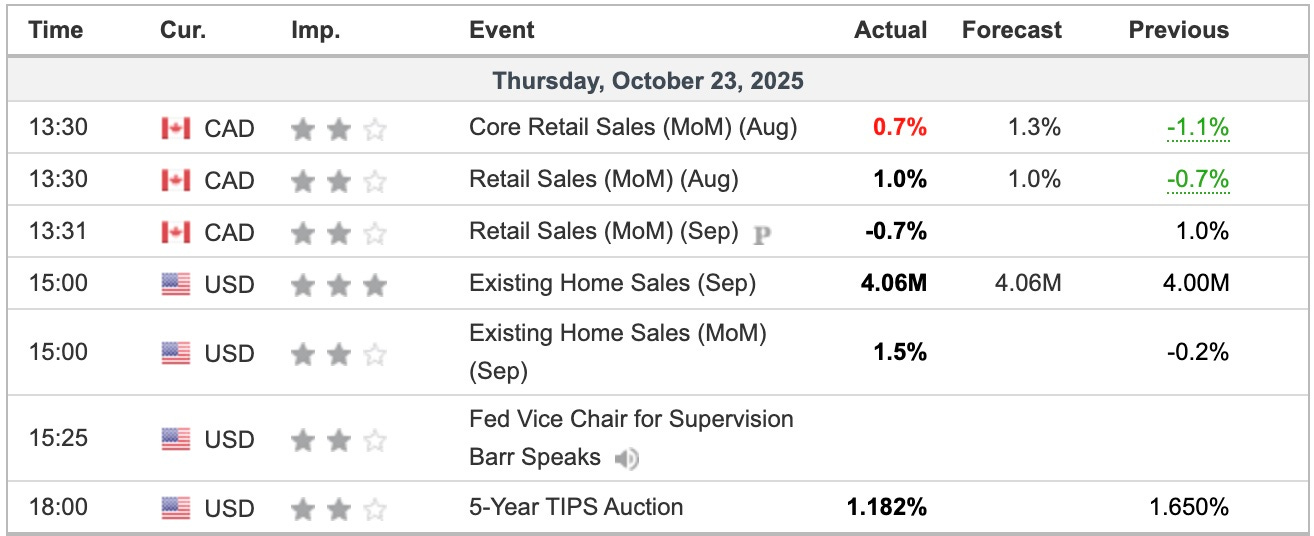

Canada Retail Sales were strong, and with alarming increase in CPI this week will be causing the Bank of Canada to look long and hard at their strategy, if they have one.

August 2025 Actuals:

Retail sales rebounded strongly, rising 1.0% month-over-month (m/m) to C$70.4 billion, beating expectations and recovering from July’s 0.8% decline. Growth was driven by:

Motor vehicle and parts dealers: +1.8% (new cars up 2.3%).

Clothing and accessories: +3.2%.

General merchandise: +2.4%.

Core sales (excluding autos and gas): +1.1% m/m.

September 2025 Advance Estimate: Sales are projected to fall 0.7% m/m, based on partial survey responses (48.4% of companies). This preliminary figure is subject to revision in the full November release.

In the US Existing Home Sales showed a strong rebound.

Equities confounded the doomsayers with a nice rally.

Breaking

Exclusive: China state oil majors suspend Russian oil buys due to sanctions, sources say [Reuters]

Bank of America Warns of Forced Stocks Selling If Credit Problems Persist [Bloomberg]

China overtakes US as Germany’s top trading partner [Reuters]

BOJ sees signs of overheating in Japan’s stock market [Reuters]

Yen slides as traders eye new US sanctions, CPI data [Reuters]

For Free Subscribers

For Paid Subscribers

S&P 500 Update 24 October 2025