Financial Markets Update 23 October 2025

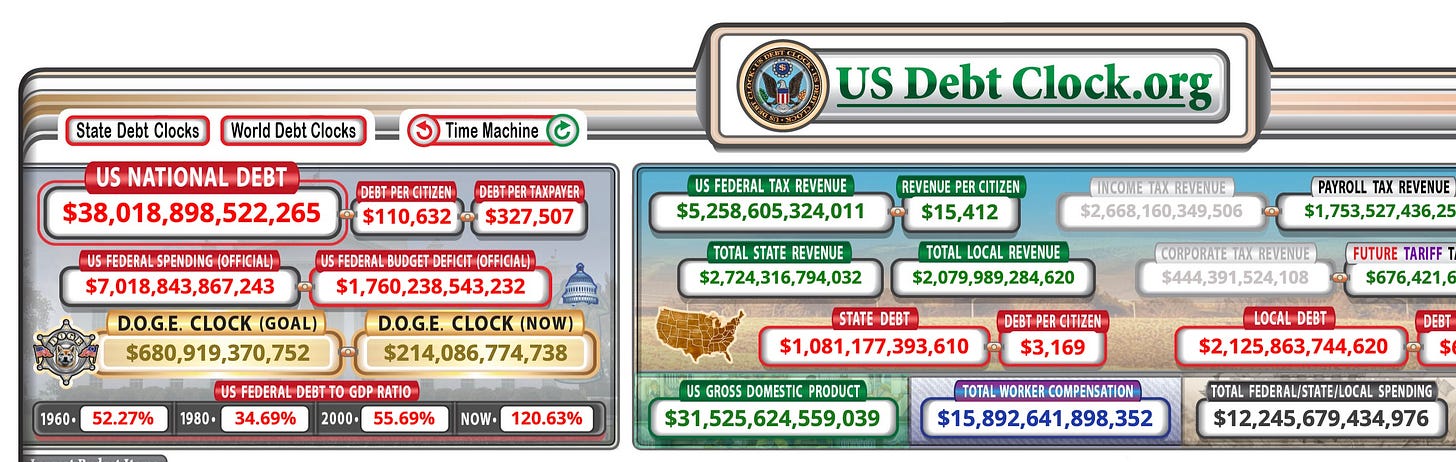

38 Trillion

News Overnight

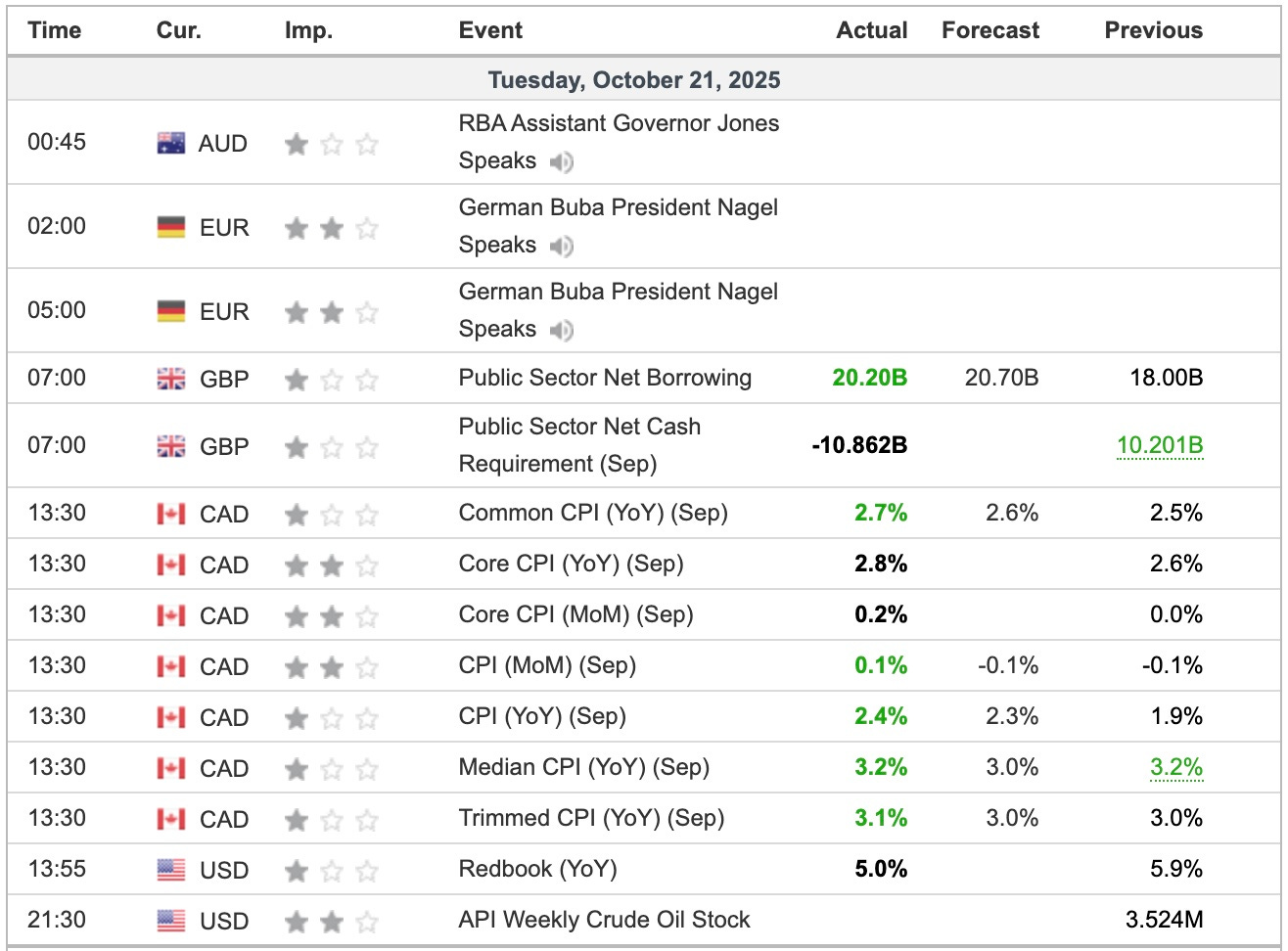

Surprisingly lower CPI in the UK gave Gilts a good rally as Gold and Silver attempt to find a base, Bitcoin underperforms with a stable USD and rates.

It seems the FED won’t just be flying blind, they’ll be flying into fog, after ADP stopped providing its data to the Fed shortly after a speech by Fed governor Christopher Waller in late August drew attention to the central bank’s longstanding use of its weekly payroll data.

Fed Lost Access to Private Jobs Data Ahead of Government Shutdown [Wall St Journal]

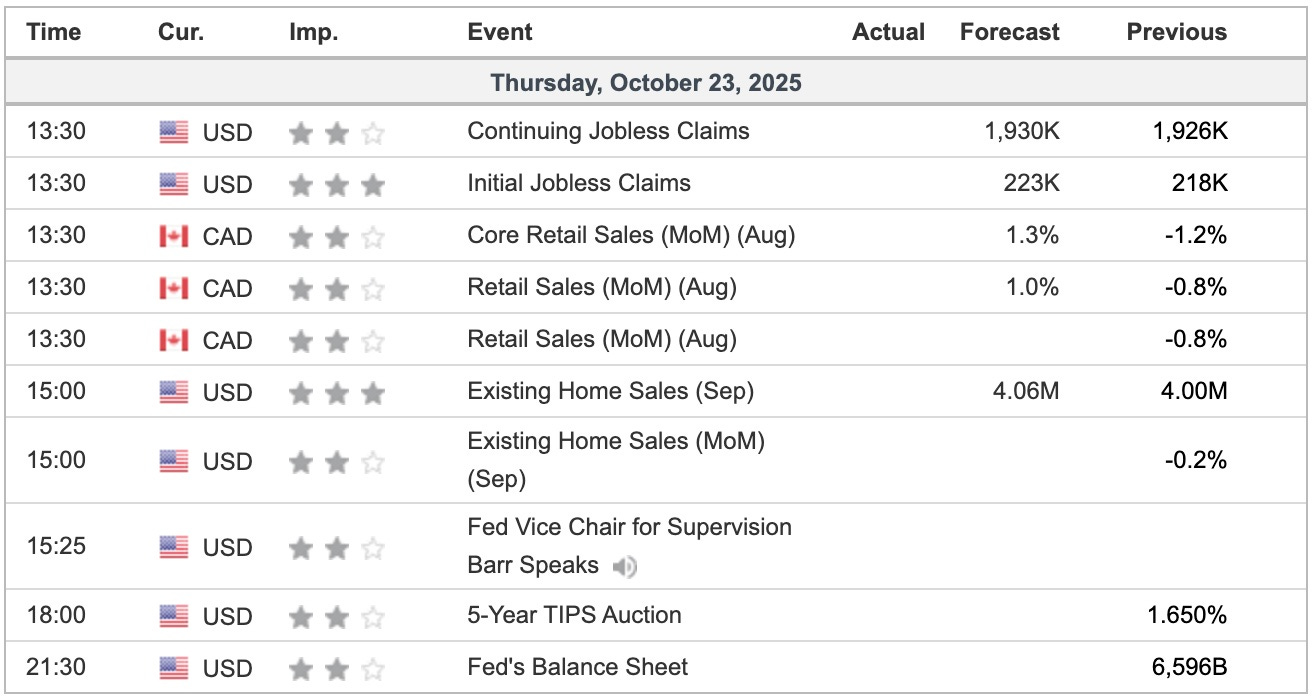

US Equities sagged as central bank week draws near.

Breaking

Fed Floats Plan With Much Smaller Capital Hikes for Big Banks [Bloomberg]

Russia Is Creating a Legal System For Crypto To Avoid Western Sanctions [Yahoo! Finance]

Exclusive: US considering curbs on exports to China made with US software, sources say [Reuters]

US seeks 1 million barrels of oil for Strategic Petroleum Reserve [Reuters]

Bank of England chief warns of ‘worrying echoes’ of 2008 financial crisis [The Guardian]

US, Korea Focusing on Structure of $350 Billion Deal, Not Swap [Bloomberg]

For Free Subscribers

S&P 500 Update 23 October 2025

USD/YEN Update 23 October 2025

For Paid Subscribers

Bitcoin Update 23 October 2025