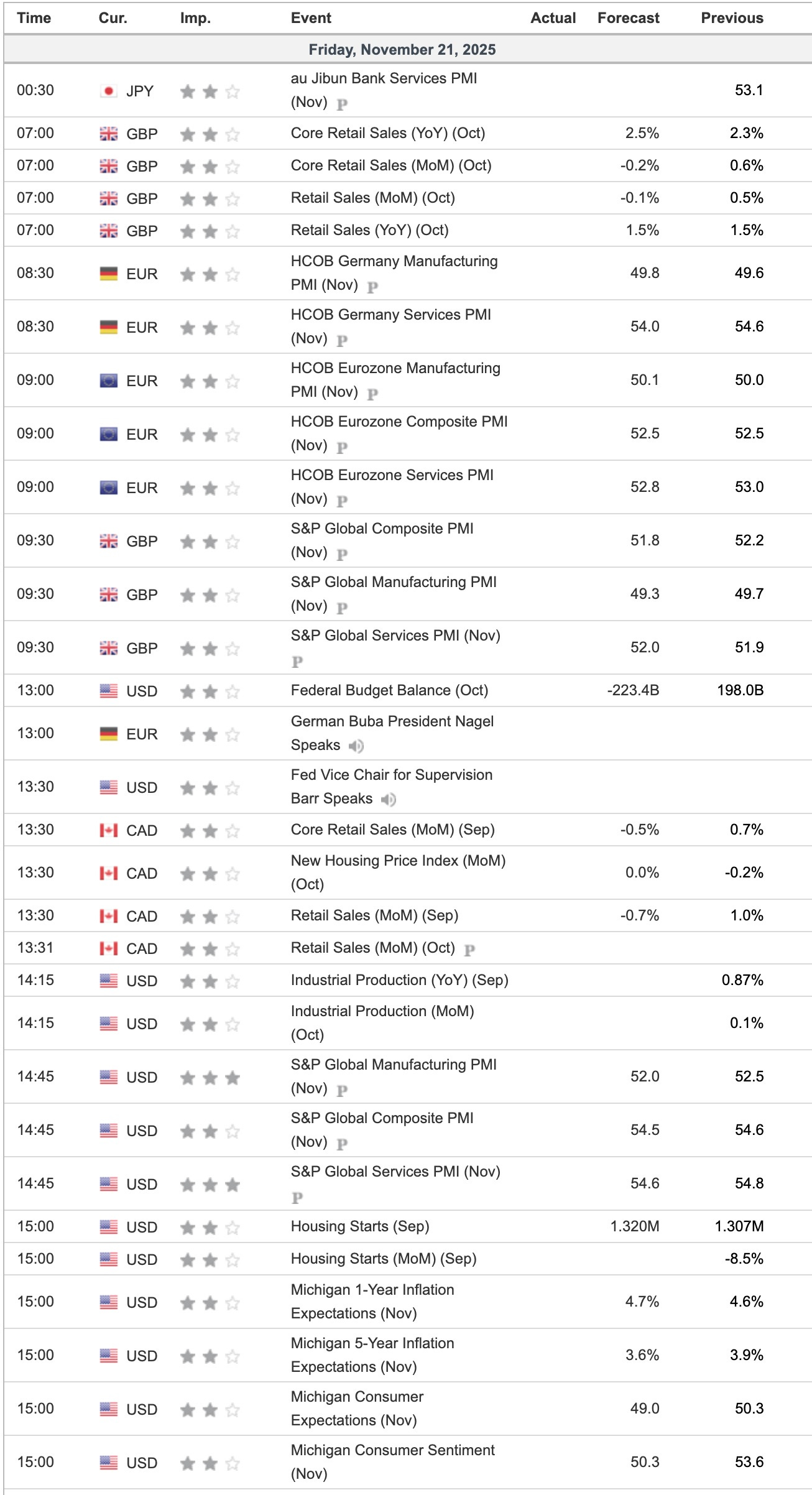

Financial Markets Update 21 November 2025

Risk-off everywhere

News Overnight

BLS spewed out a load of old data yesterday including September’s Nonfarm Payroll, which came in higher than expected although the Unemployment Rate rose to 4.4%.

Nvidia results were great but the market didn’t rally too much and by the end of the day all Indexes were significantly lower.

Japanese rates kept rising as the row with China deepened

It’s all risk-off

Breaking

US tech stocks slide as jolt of volatility hits Wall Street [FT]

Japan’s borrowing costs at highest in decades on fears of public spending surge [FT]

Top Fed official warns on risk hedge funds pose to $30tn Treasury market [FT]

China Weighs New Property Stimulus Package as Crisis Lingers [Bloomberg]

Fed Fractures Deepen as Barr Signals Inflation Concern [Bloomberg]

Global crypto rules for banks need reworking, says Basel chair [FT]