Financial Markets Update 19 December 2025

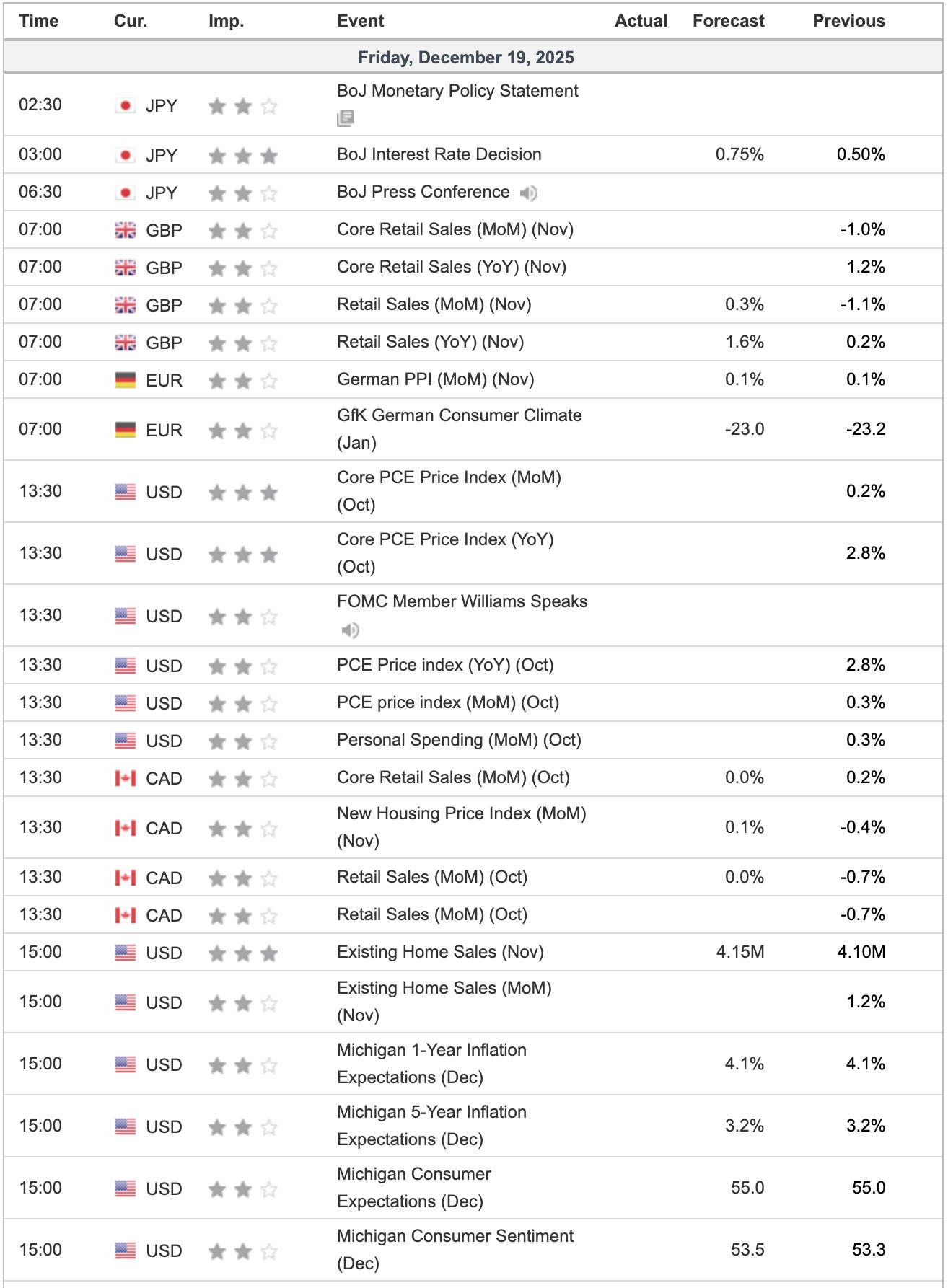

Only the Bank of Japan left

News Overnight

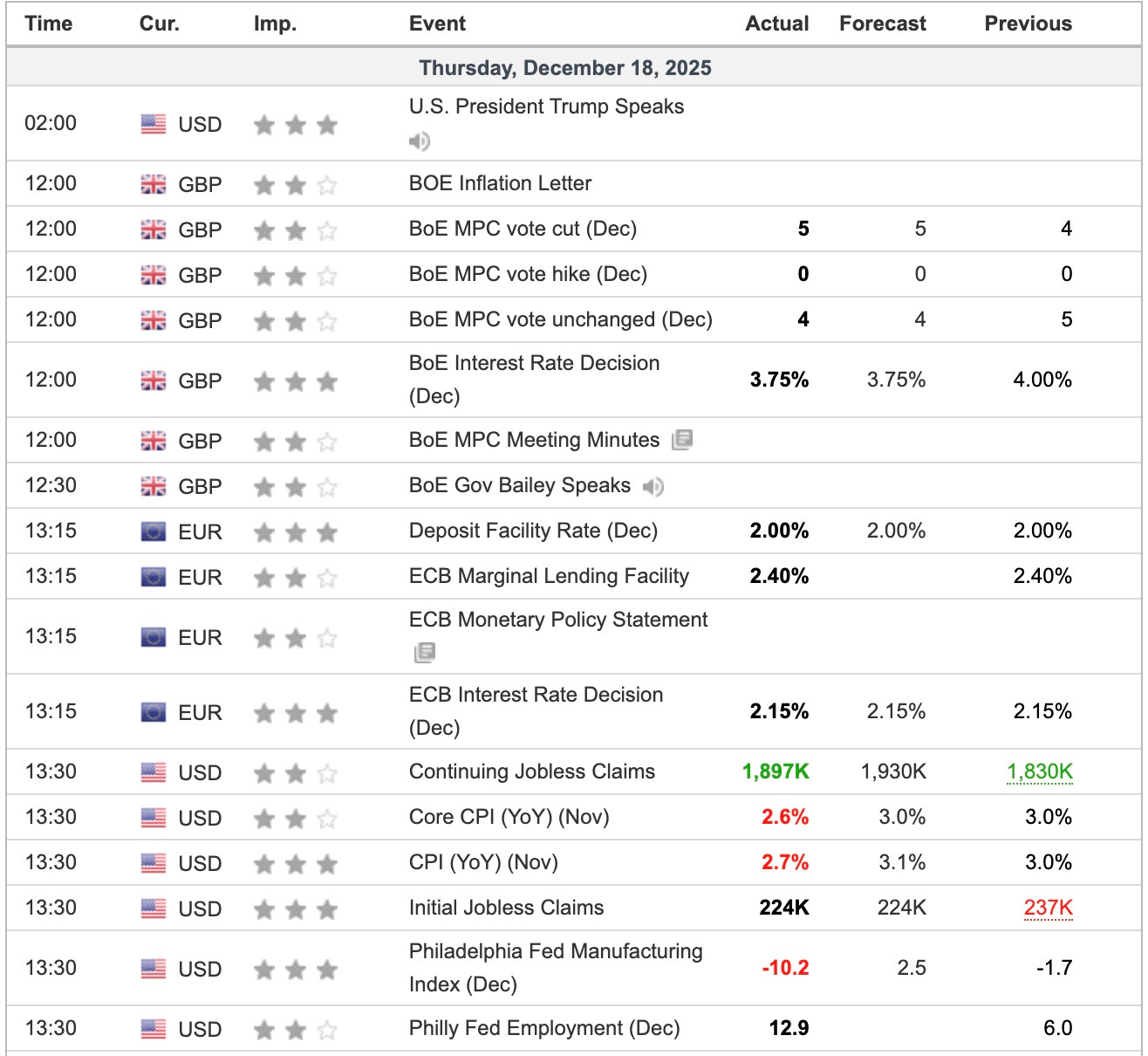

Bank of England cuts 25bps

The Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to cut the Bank Rate by 0.25 percentage points to 3.75%. This decision reflects ongoing efforts to manage inflation, which stood at 3.2% in November 2025—above the 2% target—but is projected to near 2% by Q2 2026. The MPC cited a weakening jobs market with unemployment at its highest since 2021, slowing pay growth, and a revised forecast of zero GDP growth in Q4 2025 (down from 0.3%). Officials signalled caution on further rate cuts, emphasising gradual reductions dependent on easing wage and services inflation.

European Central Bank holds

The European Central Bank’s Governing Council decided to keep its three key interest rates unchanged, with the deposit facility rate at 2.00%. Updated projections show headline inflation averaging 2.1% in 2025 (up from prior estimates), 1.9% in 2026, 1.8% in 2027, and 2.0% in 2028, while core inflation is forecasted at 2.4% in 2025. Economic growth outlook was upgraded to 1.4% for 2025, driven by stronger domestic demand, with the ECB signalling a data-dependent approach and no pre-commitment to further rate changes.

Finally US November CPI was released, or at least some of it. Numbers showed a big drop in YoY and although markets rallied, no-one believes that these numbers are accurate.

Breaking

Economists warn of flaws in US inflation report [FT]

Trump Praises Waller and Bowman, Says Fed Pick Coming in Weeks [Bloomberg]

Stocks Stage Comeback as CPI Fuels Treasury Gains: Markets Wrap [Bloomberg]

JPMorgan Is Bank Behind The Repo Crisis And The Fed’s Decision To Launch QE Lite... Again [Zerohedge]

Putin’s retaliation threat over frozen assets rattles EU capitals [FT]