Financial Markets Update 18 November 2025

Volatility rising

News Overnight

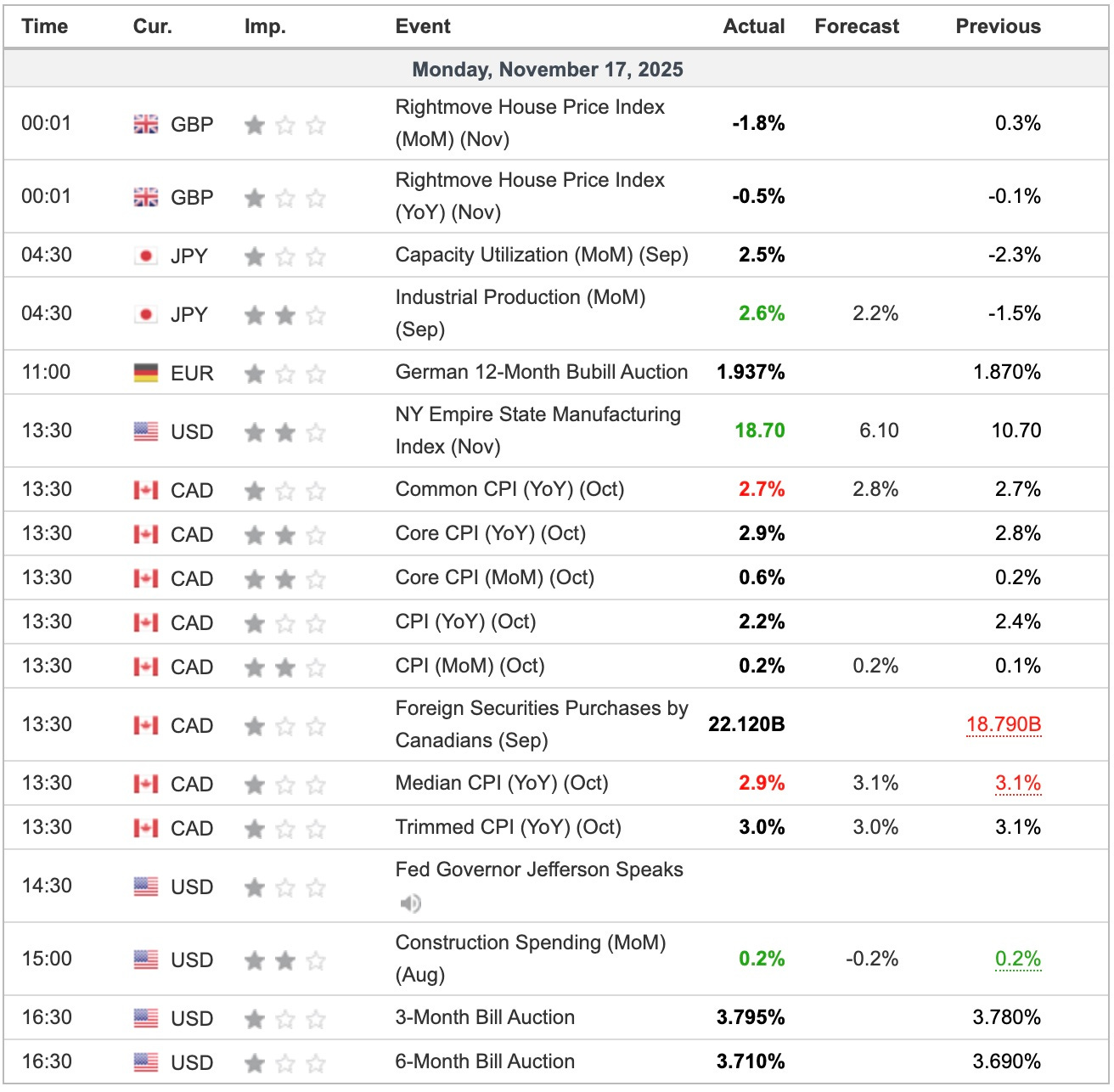

CPI is too high in Canada for the BoC to keep cutting rates. What will they do when FED unleashes QE? Australia too.

This could be the start of a sovereign debt crisis. You know what to buy.

Breaking

America’s path out of $38 trillion national debt crisis likely involves pushing up inflation and ‘eroding Fed independence,’ says JPMorgan Private Bank [Yahoo! Finance]

UBS chair talked to Scott Bessent about moving bank to US [FT]

China Property Woes Put $1 Billion of Loans at Risk in Just Days [Bloomberg]

Japan’s Katayama Strengthens FX Warning as Yen Slides Past 155 [Bloomberg]

BOJ chief to hold first bilateral meeting with PM Takaichi [Reuters]