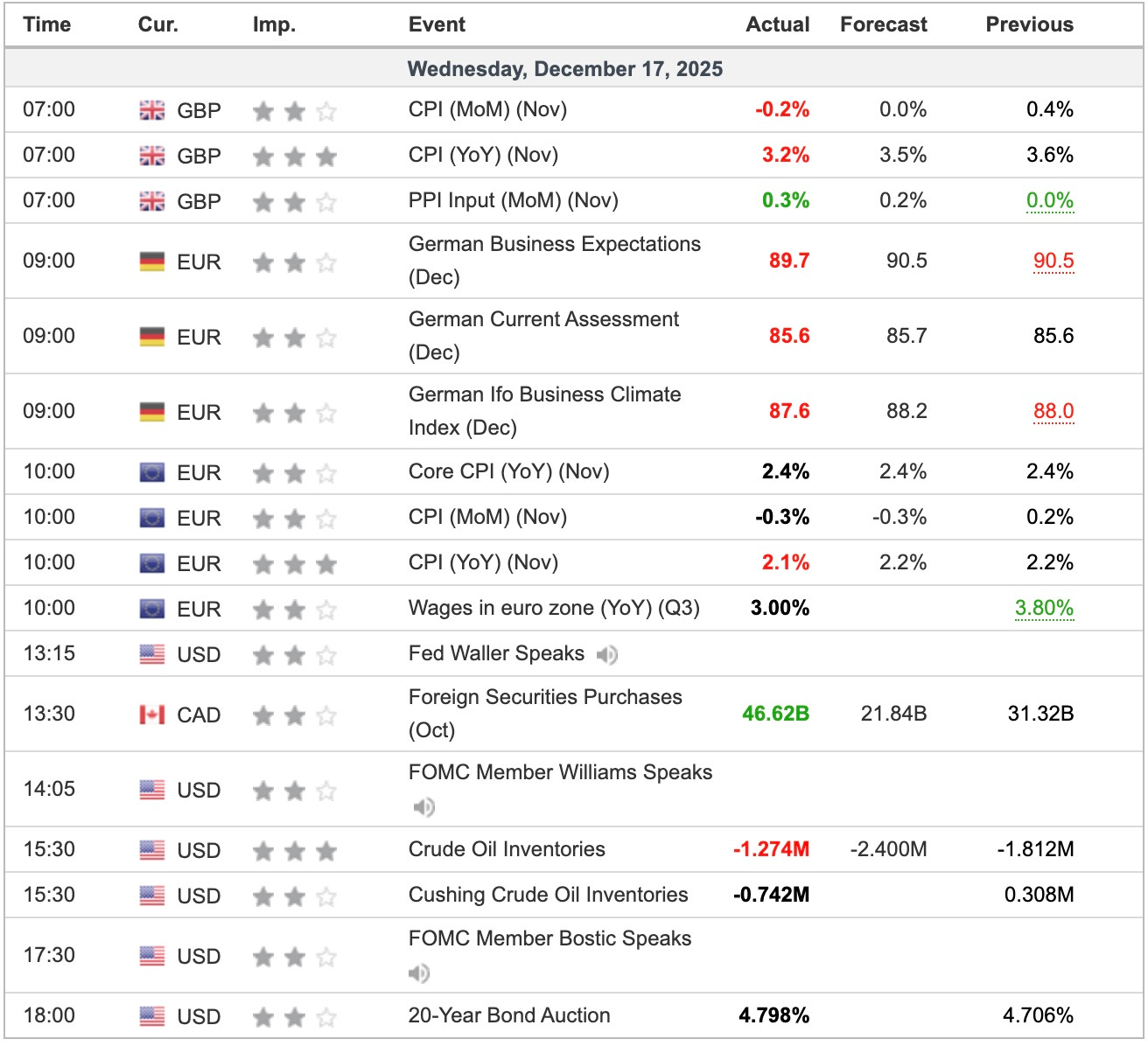

Financial Markets Update 18 December 2025

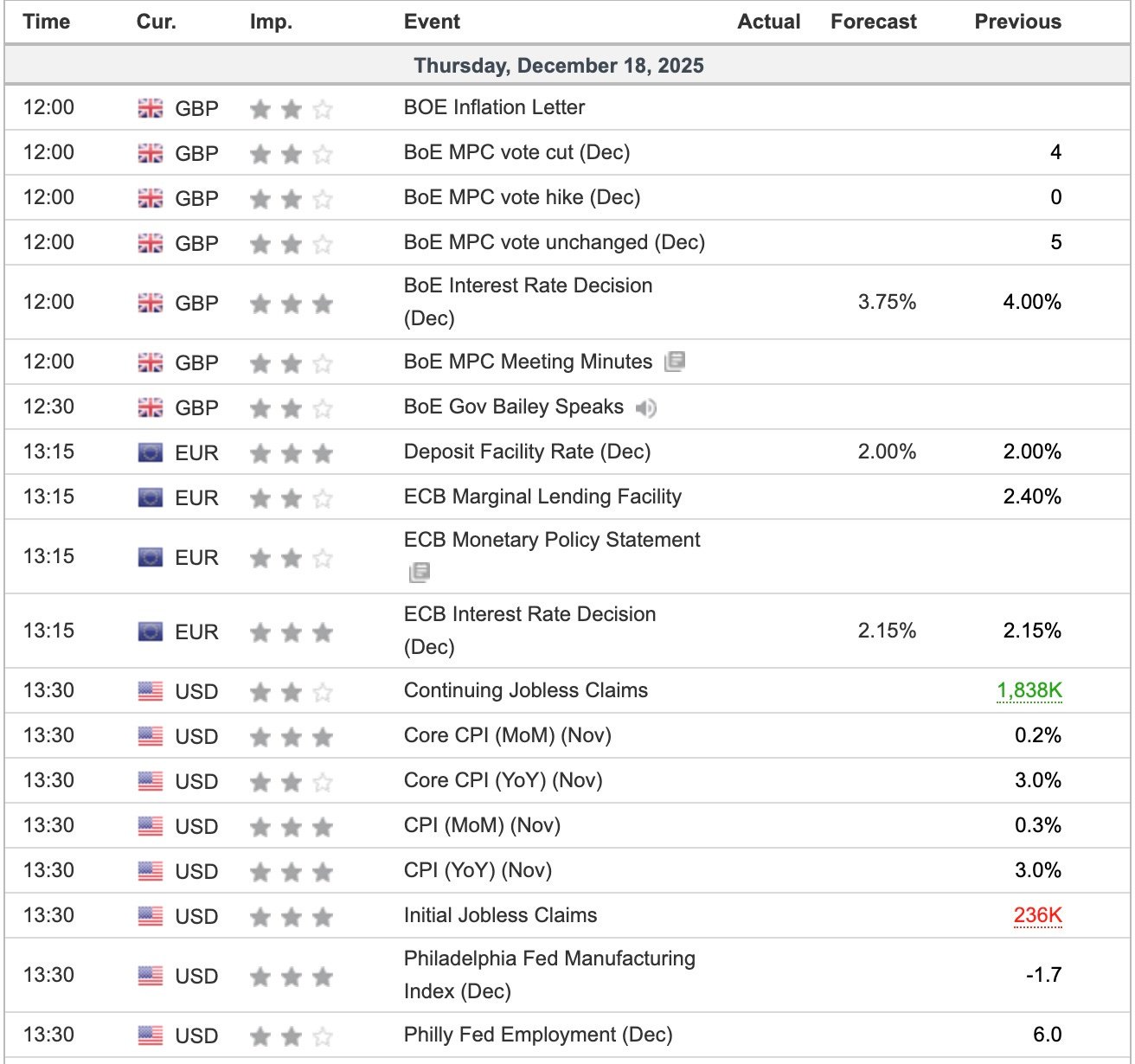

BoE, ECB and BoJ incoming

News Overnight

CPI in the UK and EU looks to have broken through the annoying, sticky levels above target at 2%. Good timing as the BoE and ECB meet today.

Gold and Silver continue to push higher, and equities roll over. We have BoJ tomorrow as well, but look for thin markets next week.

Breaking

Fed governor Waller says rates could be cut by as much as a full point [FT]

‘Shadow banking’ growing at double the rate of traditional lenders, FSB says [Reuters]

Oracle’s Rent Is Too Darn High [Bloomberg]

JPMorgan pulls $350bn from Fed to buy up Treasuries [FT]

Vanke to Meet With Insurers, Banks in Shenzhen as Crisis Deepens