Financial Markets Update 14 November 2025

Risk-off

News Overnight

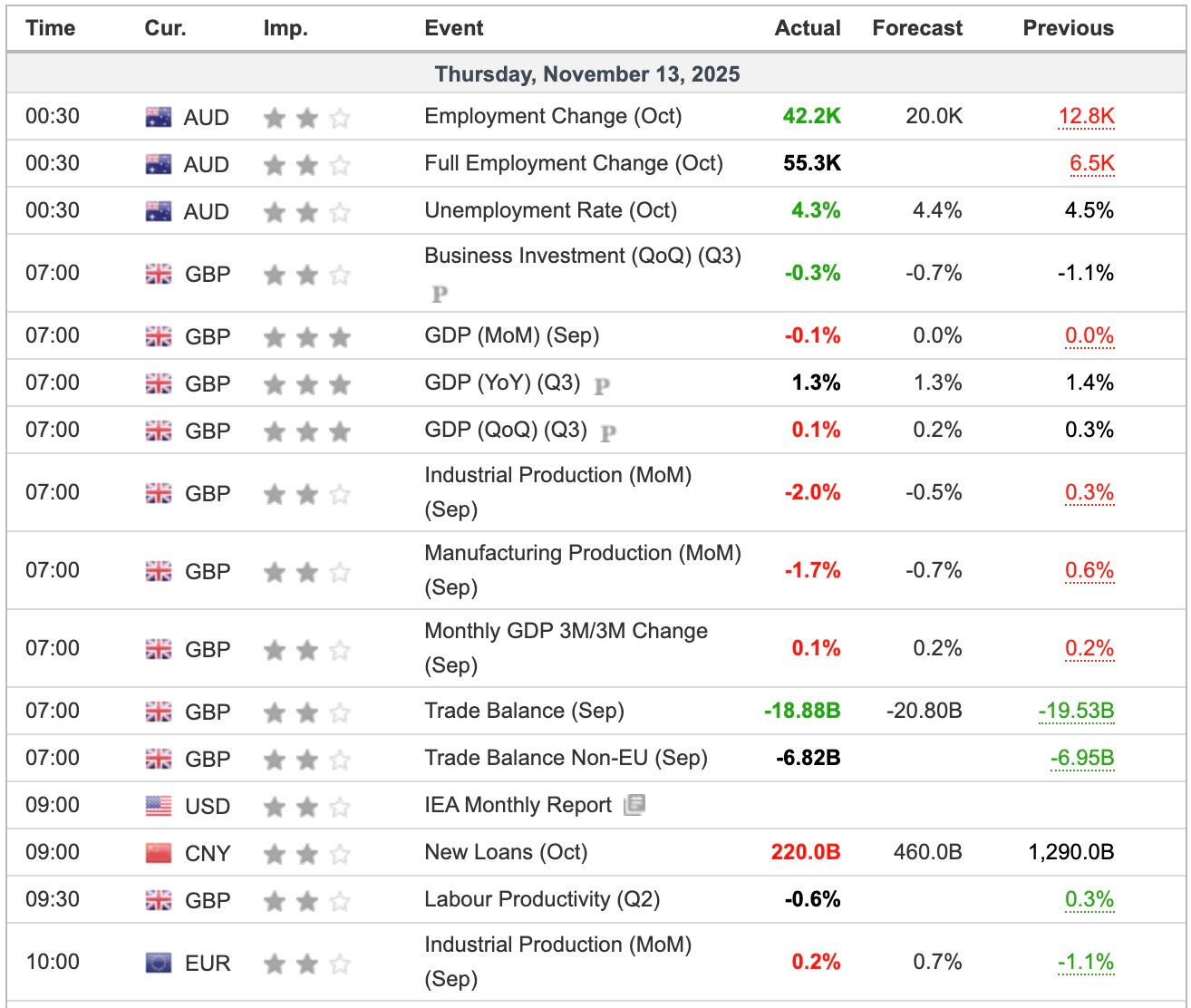

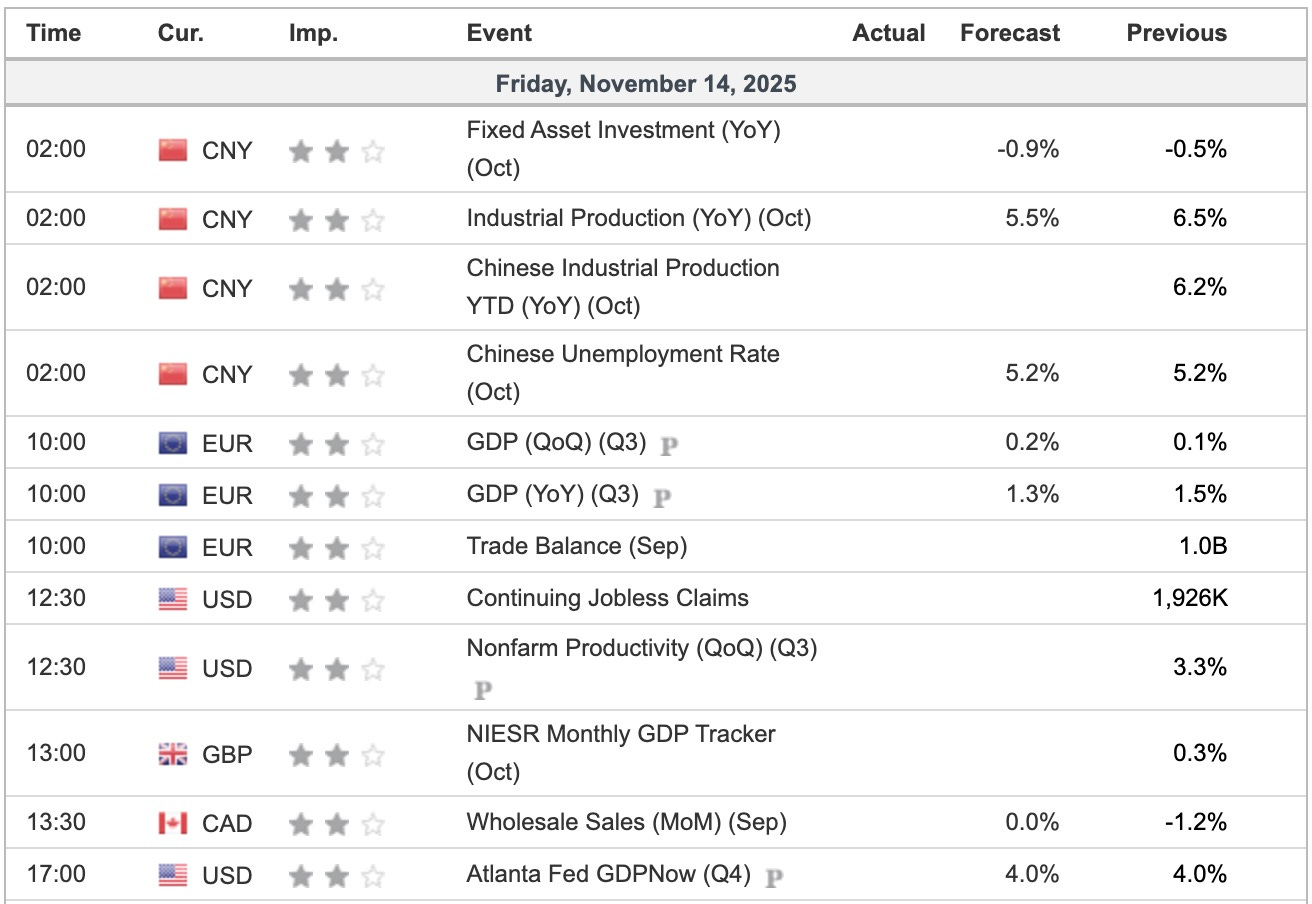

A better than expected employment report in Australia reinforces that rates can’t come down anytime soon and UK economy slipping back, were the data points of the day but there is a whole mess of US data coming and currently there is no way of telling when and how accurate.

In the background more credit and debt issues, anecdotal evidence of a widespread consumer recession in the US, Wendy’s, McDonald’s etc, and a FED the most divided in history and Boom! risk-off all round.

Breaking

Trading Day: Fed hopes melt, stocks sink [Reuters]

Stocks Churn as Wall Street Braces for Post-Shutdown Data Deluge [Bloomberg]

U.S. Insurers Are Binging on Private Credit, Moody’s Says [Wall St Journal]

US Regulators Reach Consensus on Relaxing Key Bank Capital Rule [NASDAQ]

‘Big Short’ investor Michael Burry to close fund as he warns on valuations [FT]

For Free Subscribers

For Paid Subscribers

Silver Update 14 November 2025