Financial Markets Update 13 November 2025

Something big is coming

News Overnight

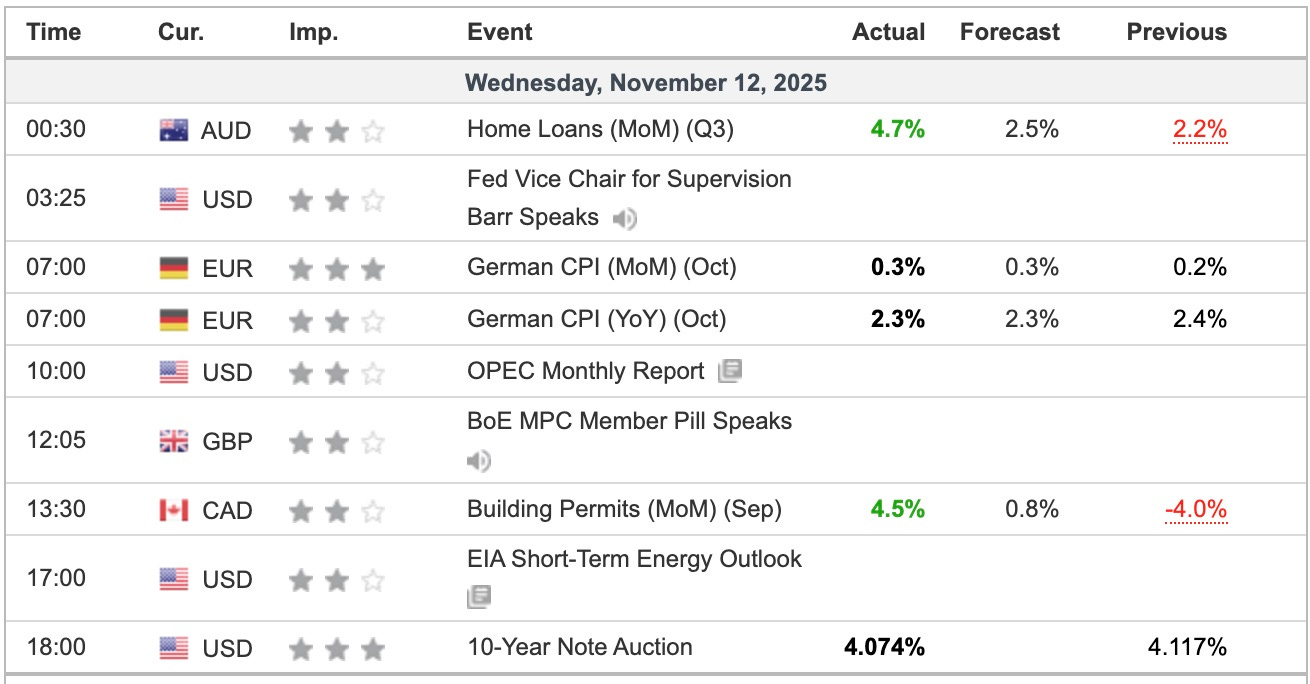

German CPI bang on expectation as markets refocus on US economy as the federal government reopens. When we start getting data is still unclear, and when it comes will it be valid? Flux again in AI related stocks as accounting shenanigans hit the headlines.

Gold and Silver are telling us that something big is about to happen

Breaking

Oil prices fall more than $2/bbl as OPEC says 2026 supply to match demand [Reuters]

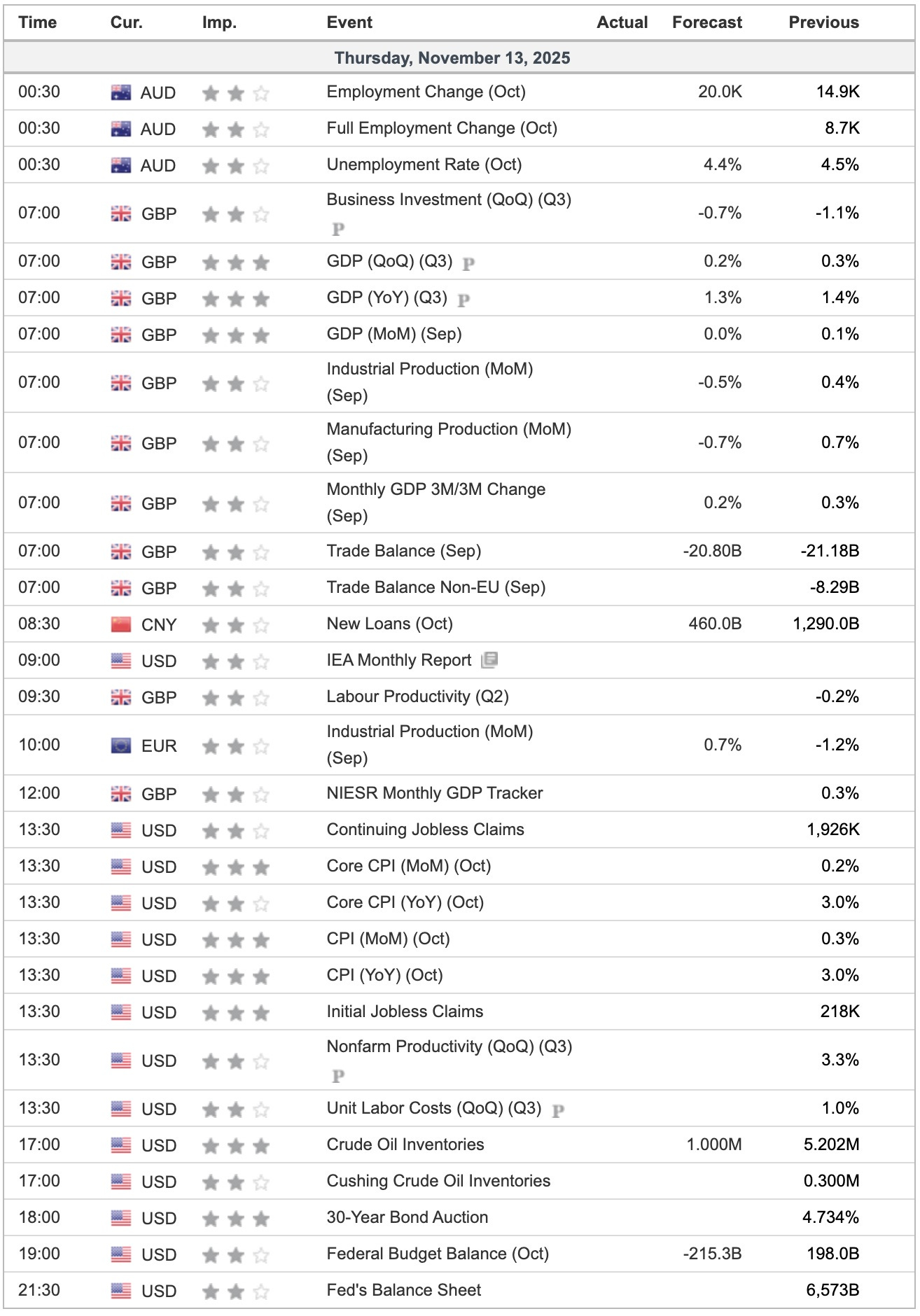

The Fed Is Increasingly Torn Over a December Rate Cut [Wall St Journal]

October Jobs, CPI Data Unlikely to Be Released, White House Says [Bloomberg]

Institutional clients are buying the dip in stocks says BofA [investing.com]

For Free Subscribers

For Paid Subscribers

Silver Update 13 November 2025

Bitcoin Update 13 November 2025

US 10 Year Yield Update 13 November 2025