Financial Markets Update 12 December 2025

Markets digest the FED's presser

News Overnight

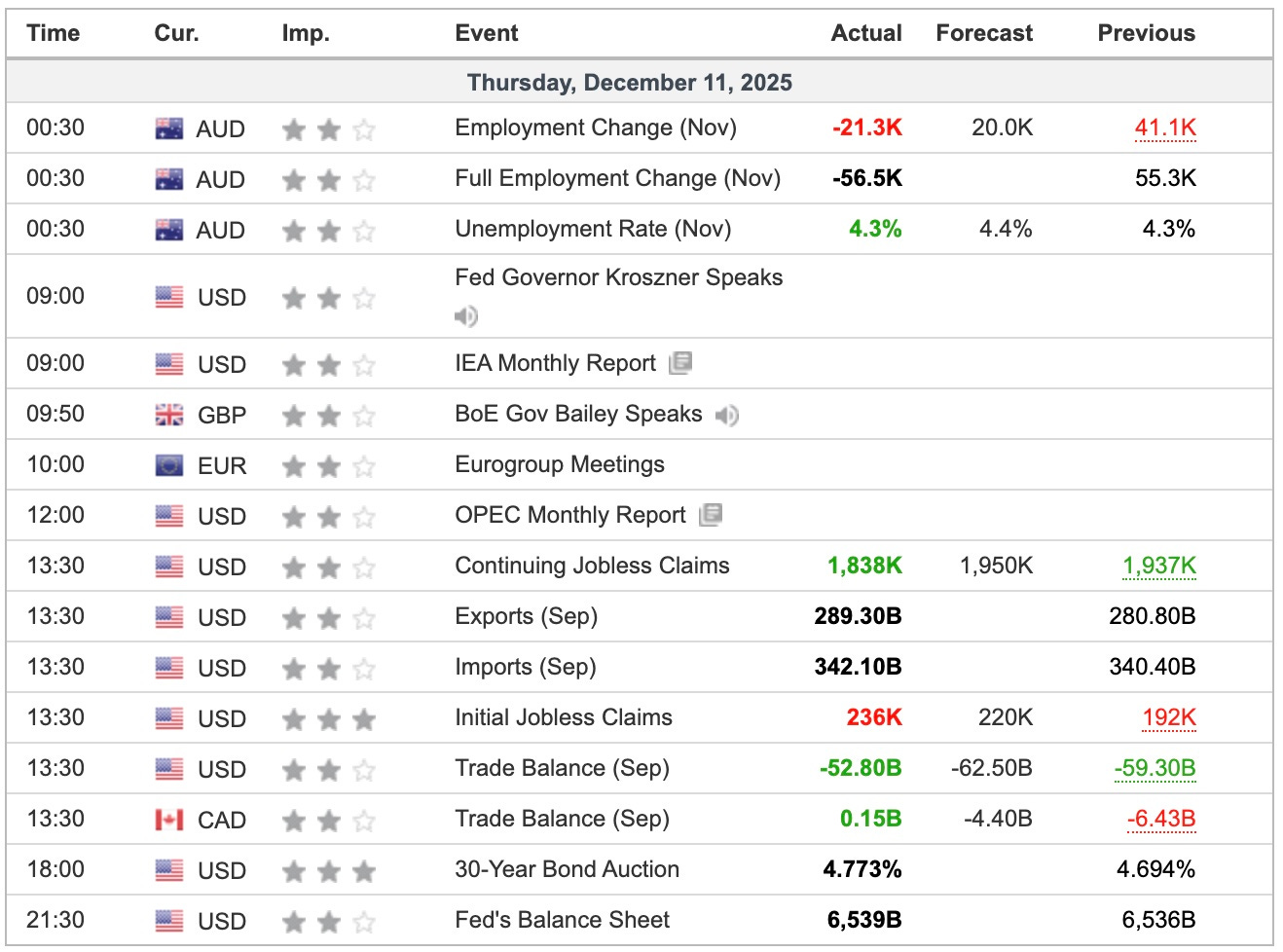

A big miss in the Australian jobs report helped defray the speculation that the next interest rate move would be up. And US Initial Jobless Claims rose more than expected. The US Treasury even managed to get the 30 year auction away without any fuss.

It was a day for markets to digest Powell’s presser and it’s implications. It’s too near the end of the year for any big reaction, but it’ll be going off on 2nd January.

Breaking

Oracle shares sink as worries swirl over huge spending on data centres [FT]

Bank of Japan reluctant to intervene on rising yields, sources say [investing.com]

US seizes oil tanker off Venezuelan coast [FT]

Mexico approves up to 50% tariffs on China and other countries [BBC]

South Korea protests at Chinese and Russian warplanes in its airspace [BBC]

Exclusive China’s Last ‘Too-Big-to-Fail’ Housing Giant Loses State Support [Bloomberg]