Financial Markets Update 10 December 2025

It's party time tonight

News Overnight

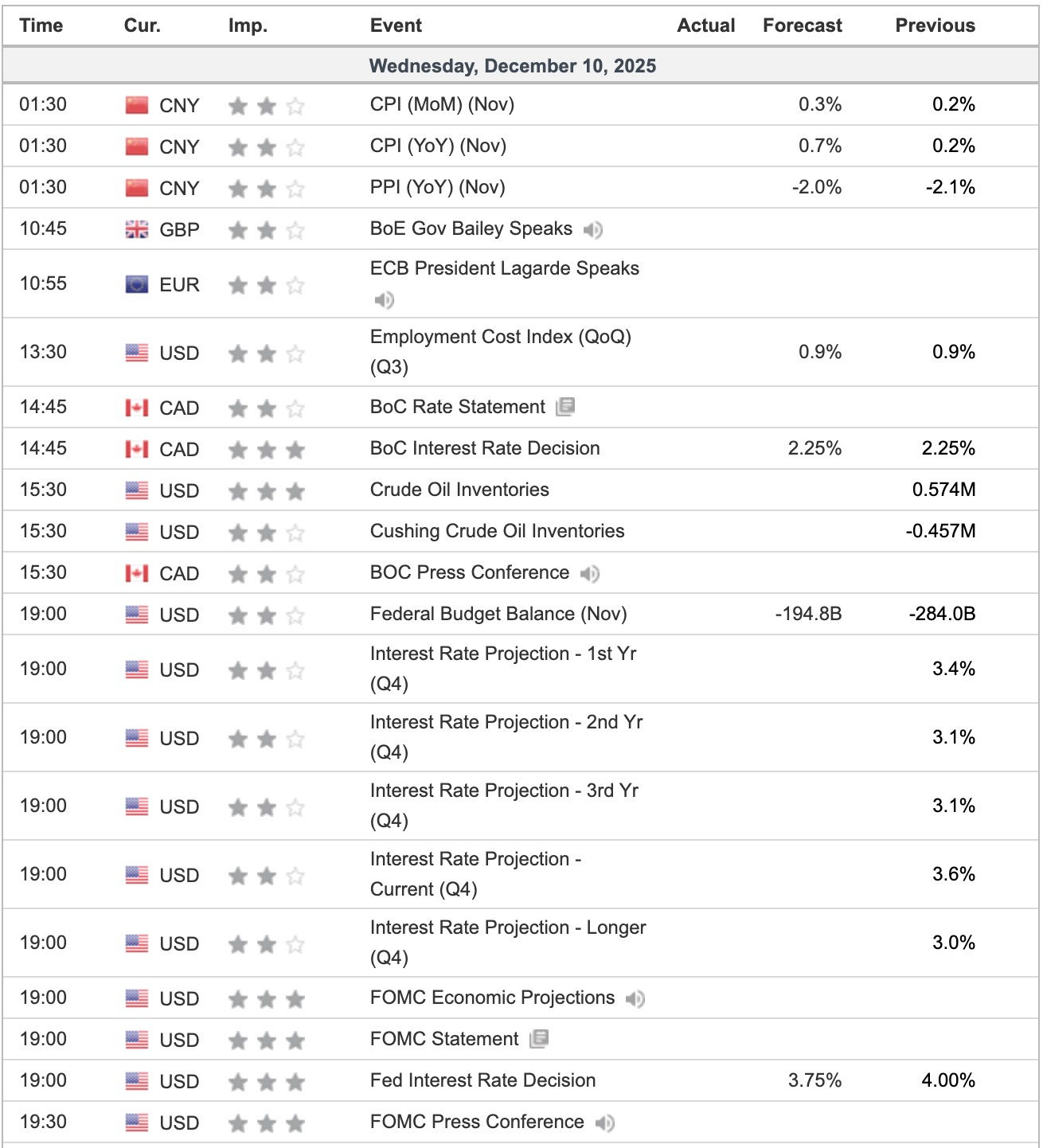

A big increase in job openings cements 25bps cut by the FED tonight but what about the presser? Never will a FED Chair’s words be more scrutinised.

Everyone, including us, forgot that it’s the Bank of Canada’s monetary policy meeting today as well and their announcement will precede the FED’s. Expect another cut and it’ll be another policy error. It’s US interest rates that need to go lower.

Markets had a good day with Silver spiking, BTC doing well and USD/YEN now the release valve for Japan.

Breaking

Trump on brink as Europe plans ‘nuclear option’ if US sells out Ukraine [Express]

Macron Calls for ECB Monetary Policy Approach Rethink [Yahoo! Finance]

Sizing up hedge funds’ relative value trades in US Treasuries and interest rate swaps [BIS]

RBA is worried it cut interest rates too far [AFR]

Rise in US job openings offers hope of labour market stabilisation [FT]

Investors warm up for long spell of discordant Fed [Bloomberg]