China CPI PPI Shock

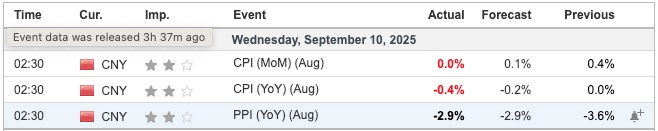

China's CPI and PPI Data for August 2025 (Released September 10, 2025)

China's National Bureau of Statistics released its inflation data on September 10, 2025, covering August 2025. The Consumer Price Index (CPI) fell into deflation territory, declining faster than expected due to weak demand and volatile food prices. The Producer Price Index (PPI) showed signs of easing deflation, with the year-on-year drop narrowing for the first time in six months, aided by government efforts to curb price wars in industries like electric vehicles.

CPI

Worse than expected (-0.2% YoY); first decline since February 2025. Core CPI (ex-food & energy): +0.9% YoY (up from +0.8% in July). Food prices: -4.3% YoY (vs -1.6% in July).

PPI

Narrowed from -3.6% YoY in July; in line with expectations. Ends five-month MoM decline.

Additional Context

CPI Breakdown: The overall drop reflects a high base effect from last year and subdued seasonal food price rises. Non-food inflation was softer, while services edged up to +0.6% YoY. For the first eight months of 2025, CPI averaged around 0.3% YoY (preliminary estimate based on trends).

PPI Breakdown: Deflation eased due to proactive policies and industry stabilisation, though global slowdowns and overcapacity persist. For the first eight months, PPI was down 2.9% YoY.

Implications: Analysts note that while PPI shows tentative recovery, persistent CPI deflation raises concerns about consumer spending and the 2% annual inflation target. Further stimulus may be needed.

Data sourced from official releases and economic reports. For real-time updates, check stats.gov.cn.